With the Federal Reserve having hiked interest rates multiple times this year, resulting in mortgage rates rising as well, there’s an undercurrent that now is not the time to buy a house. But there are savings to be had and other benefits to doing just that. People considering buying a home should not let negative news reports sway them.

Here are five reasons why it’s still a great time to become a homeowner.

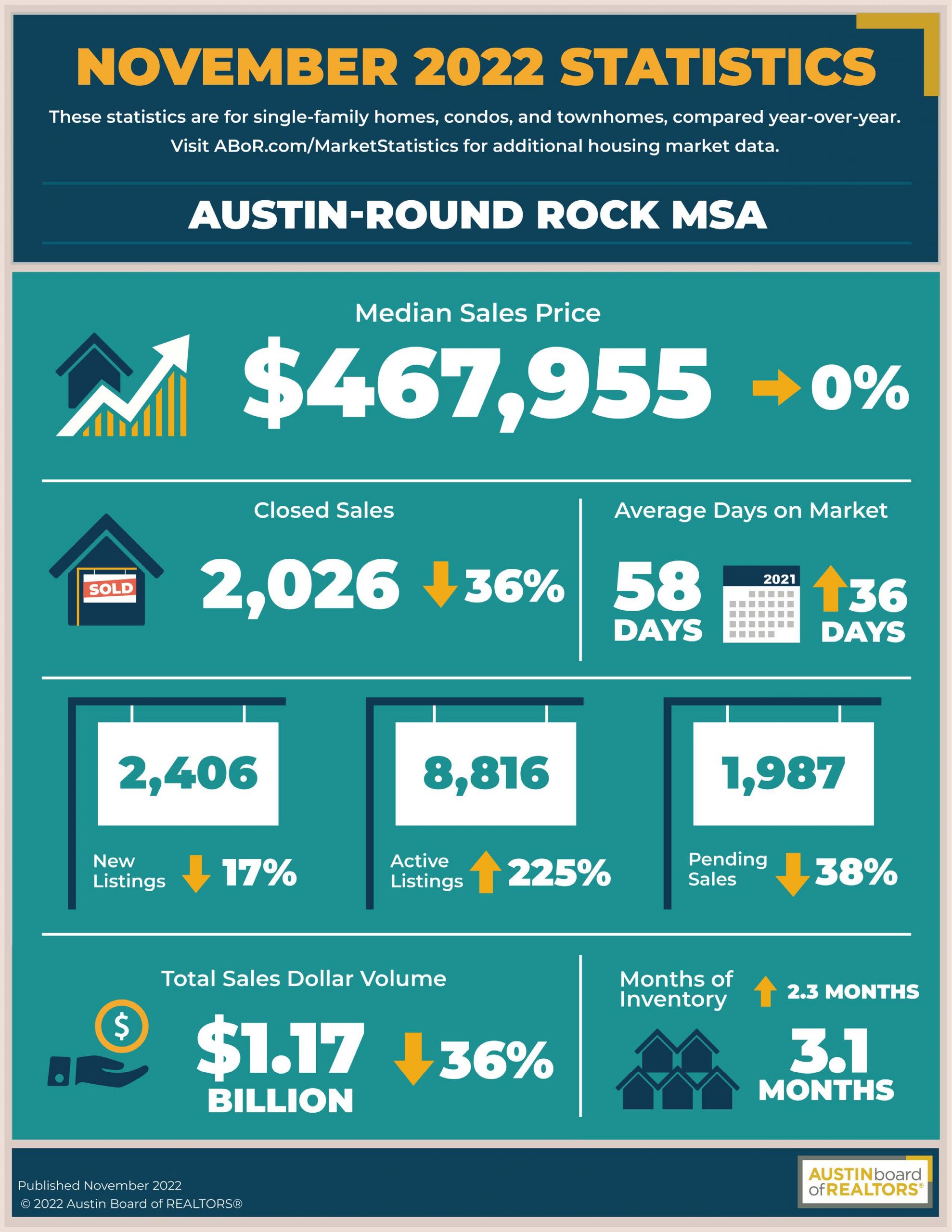

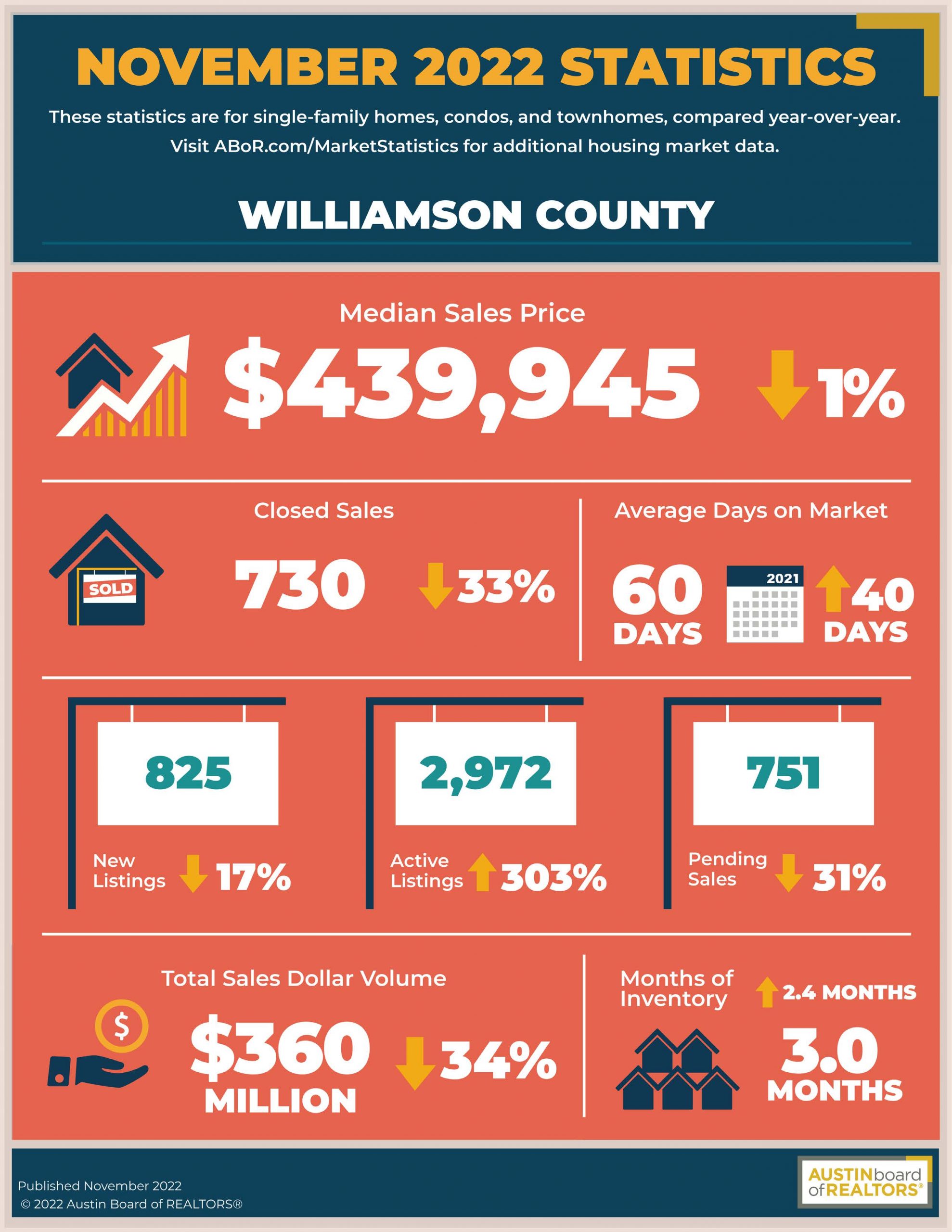

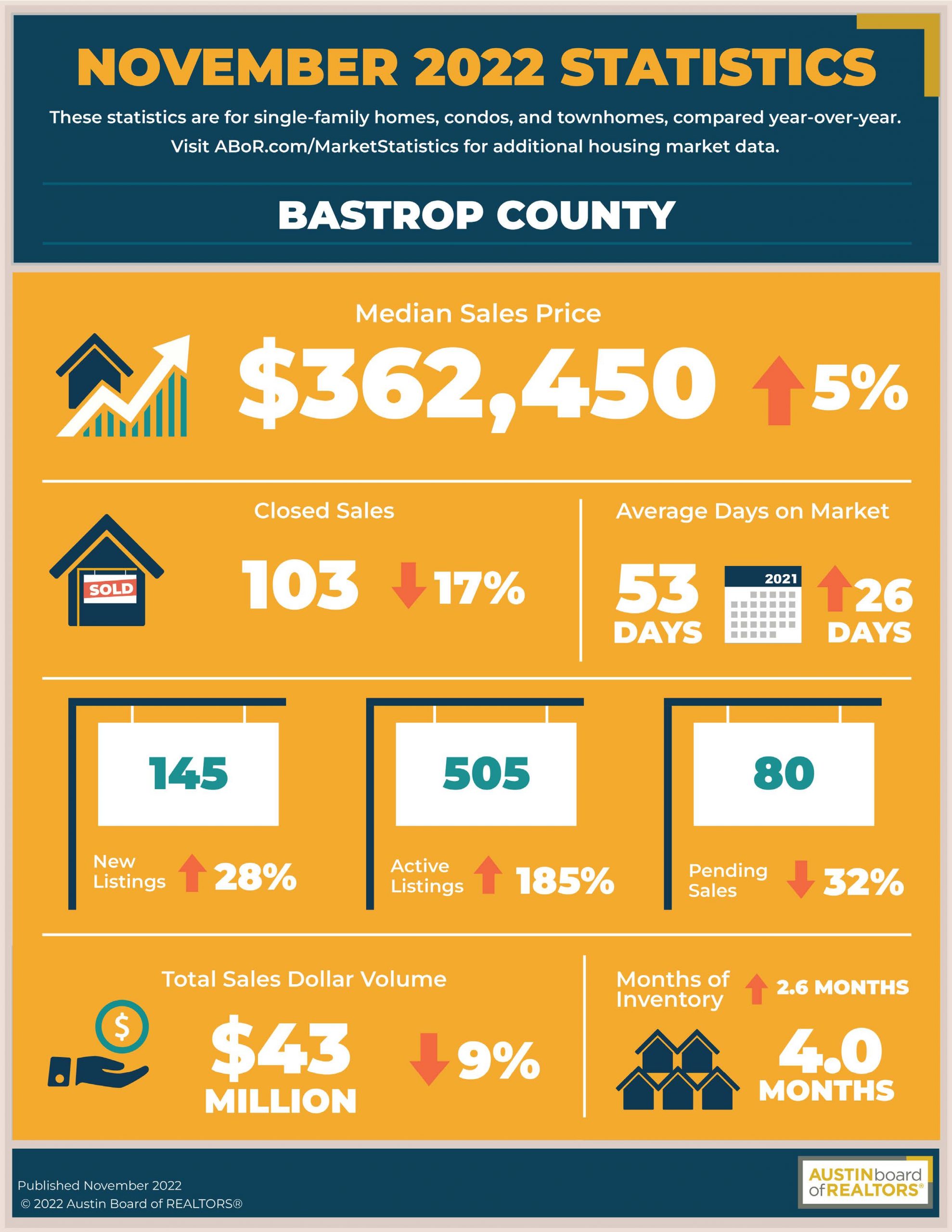

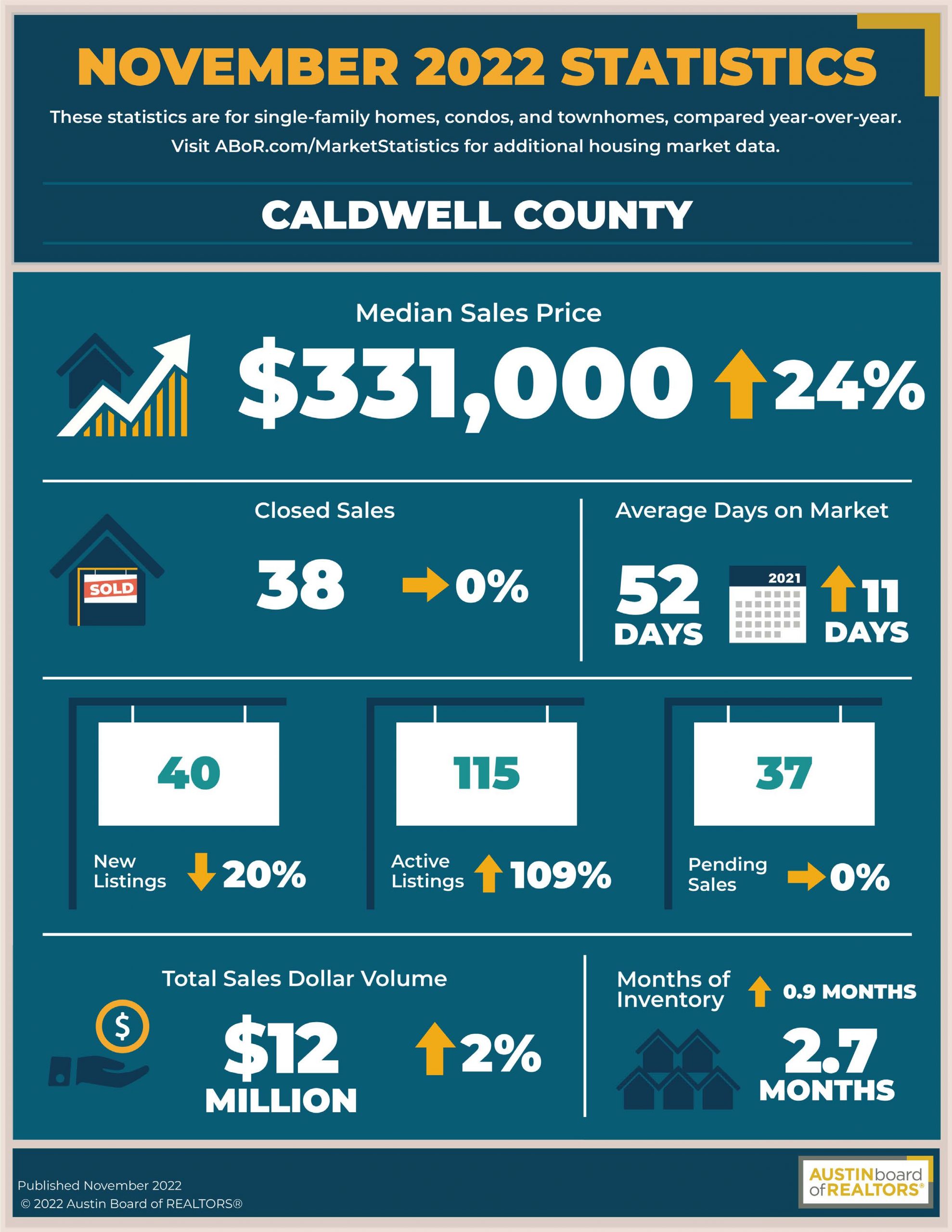

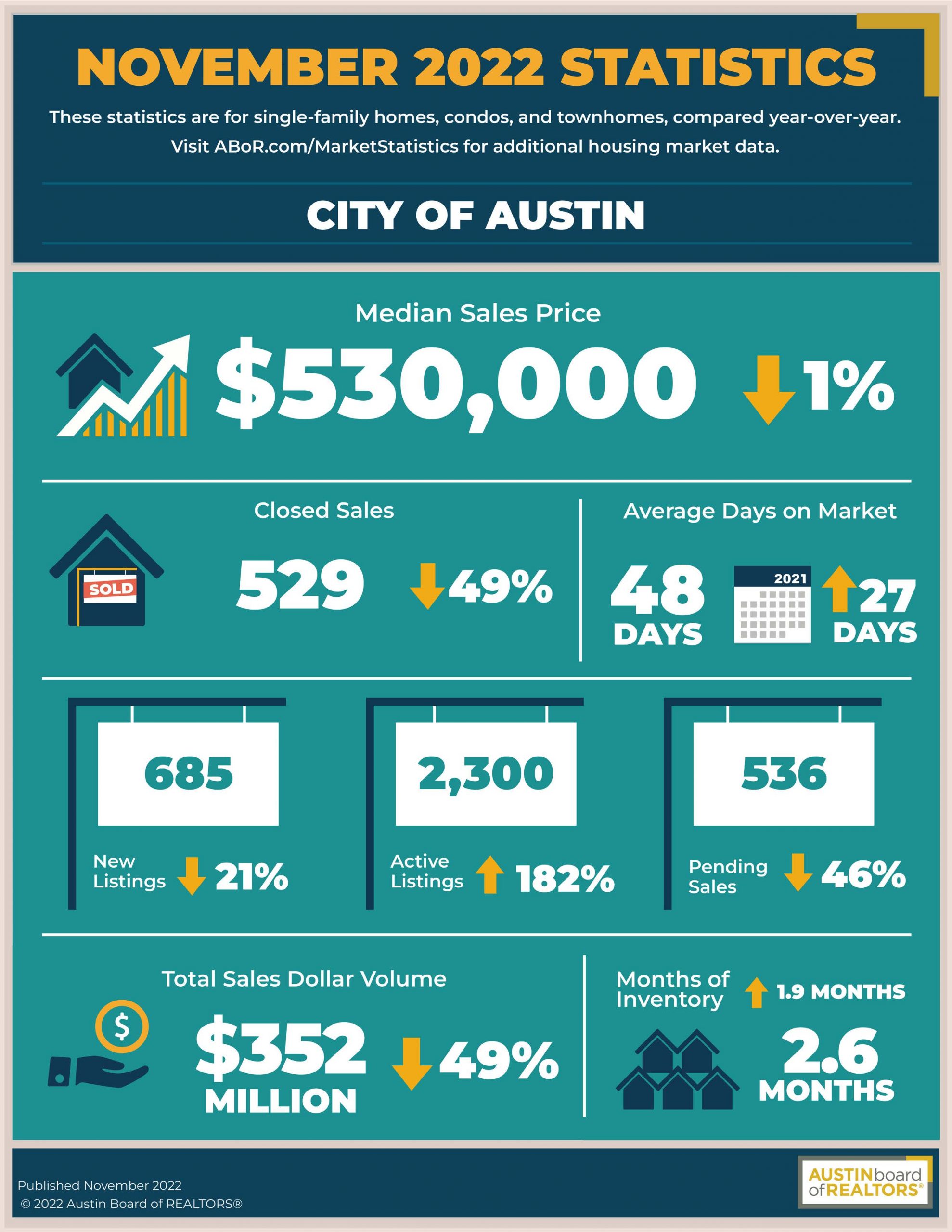

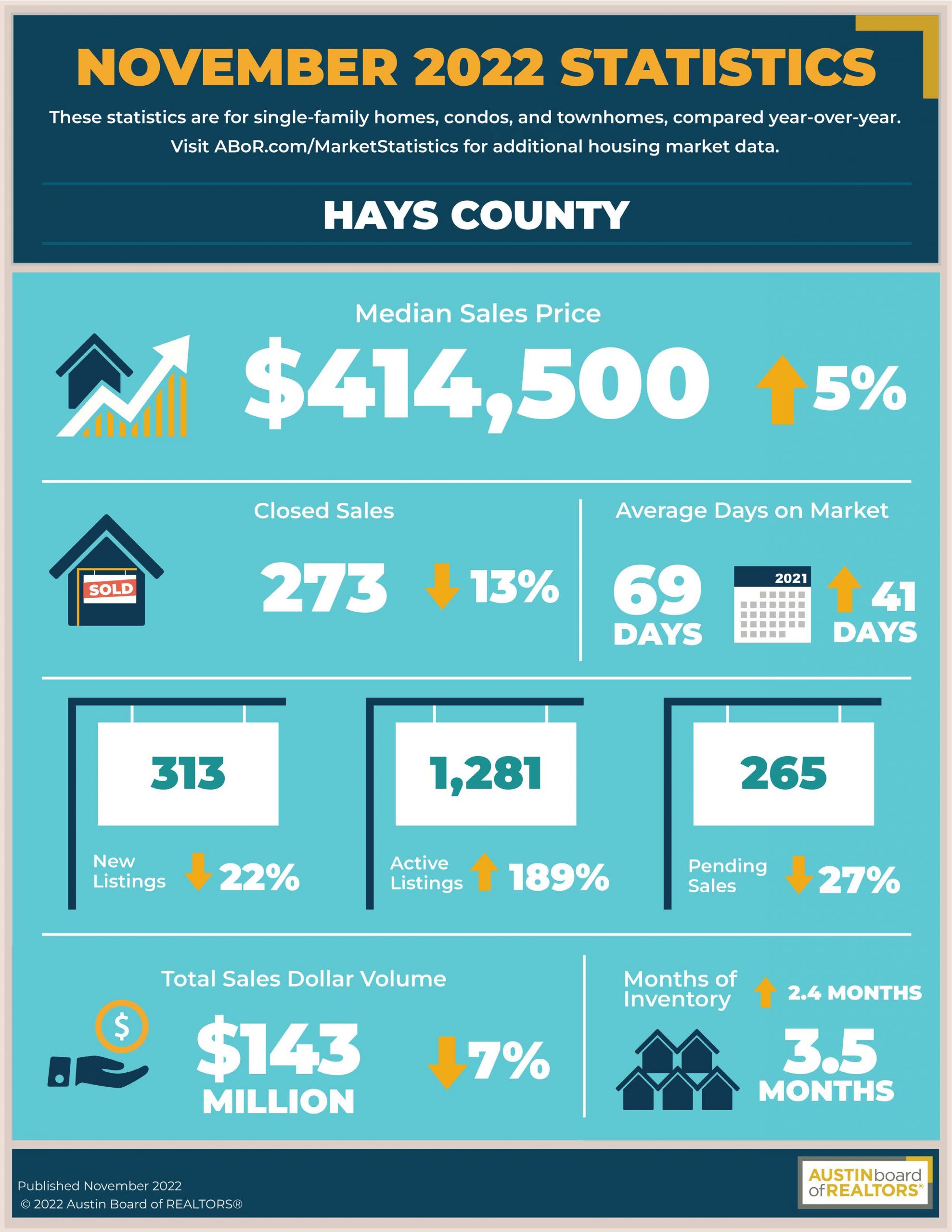

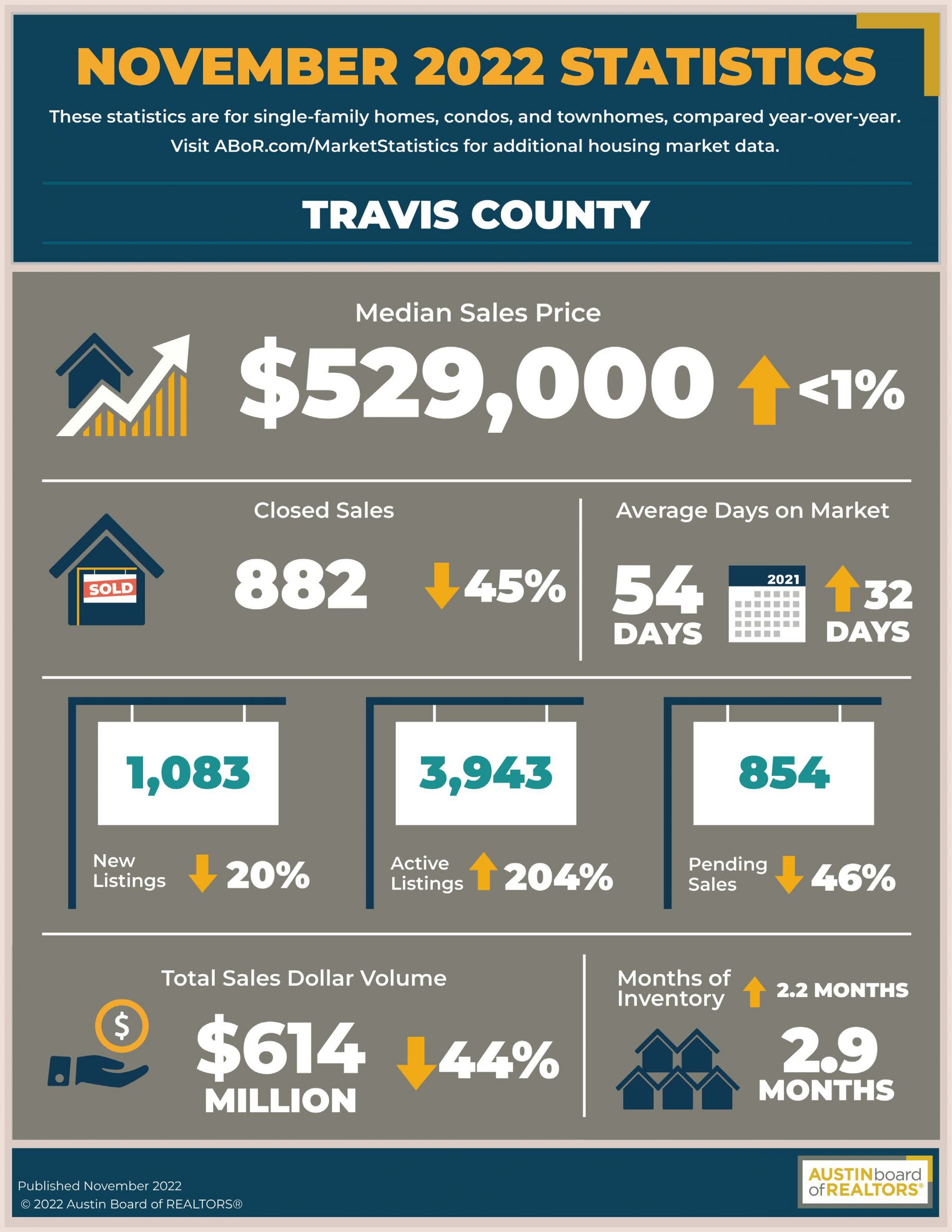

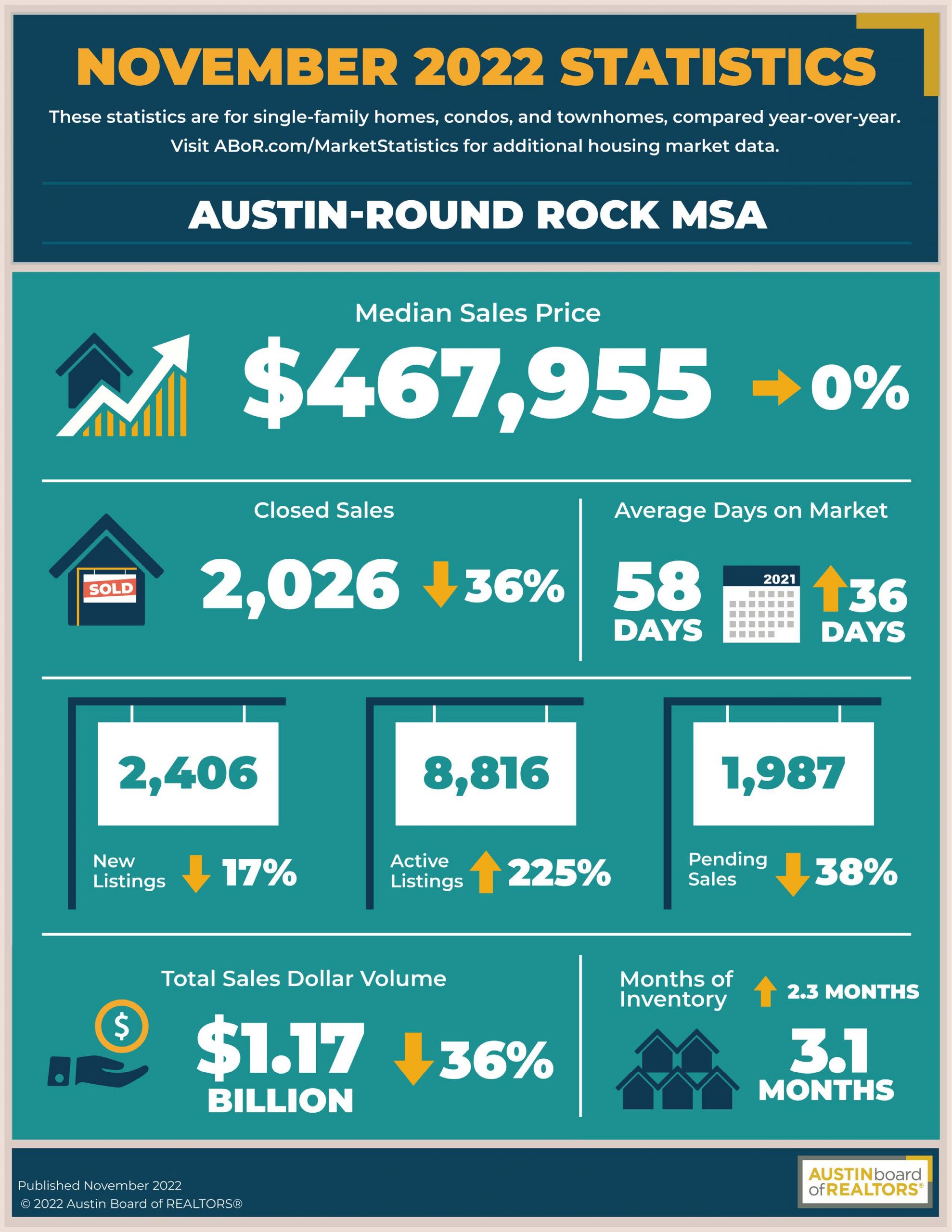

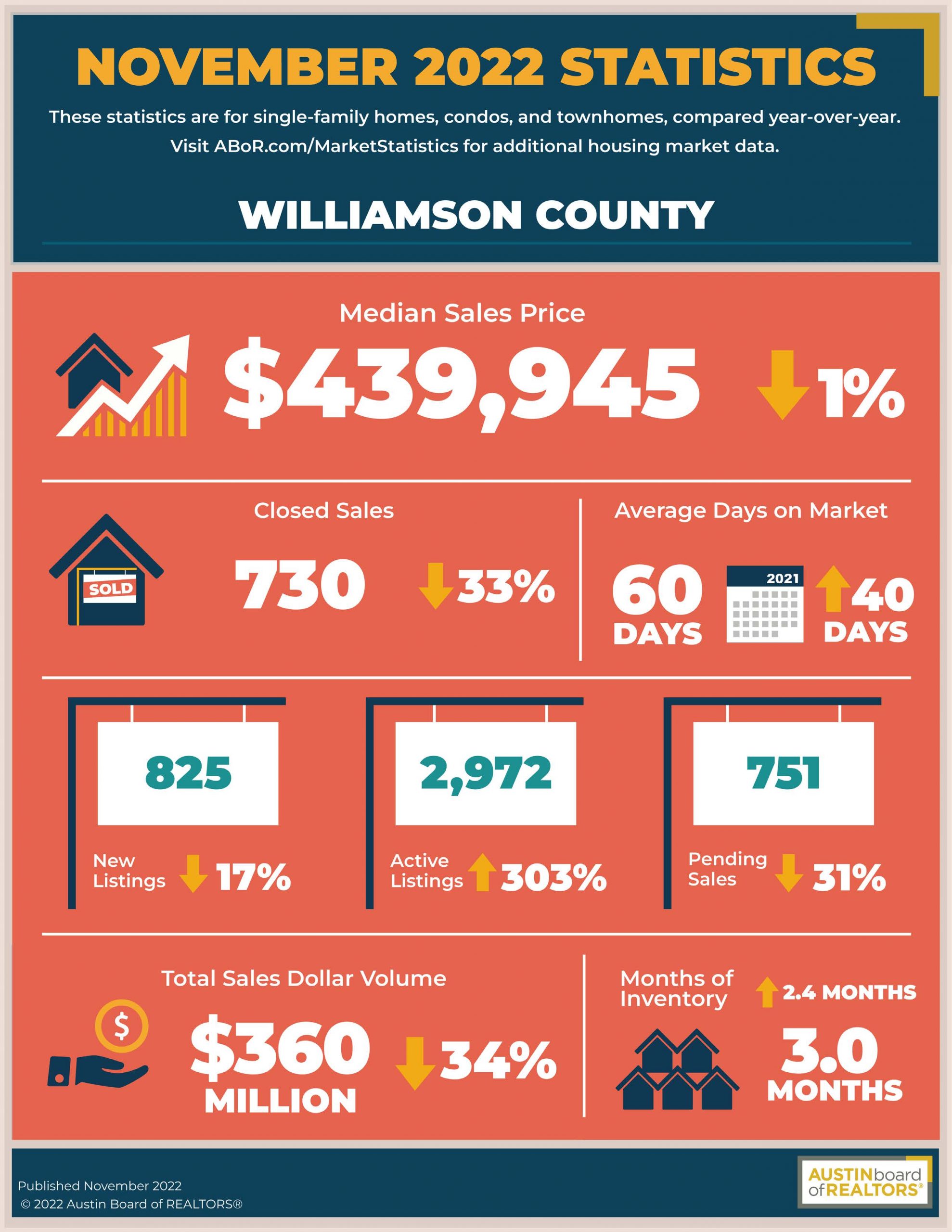

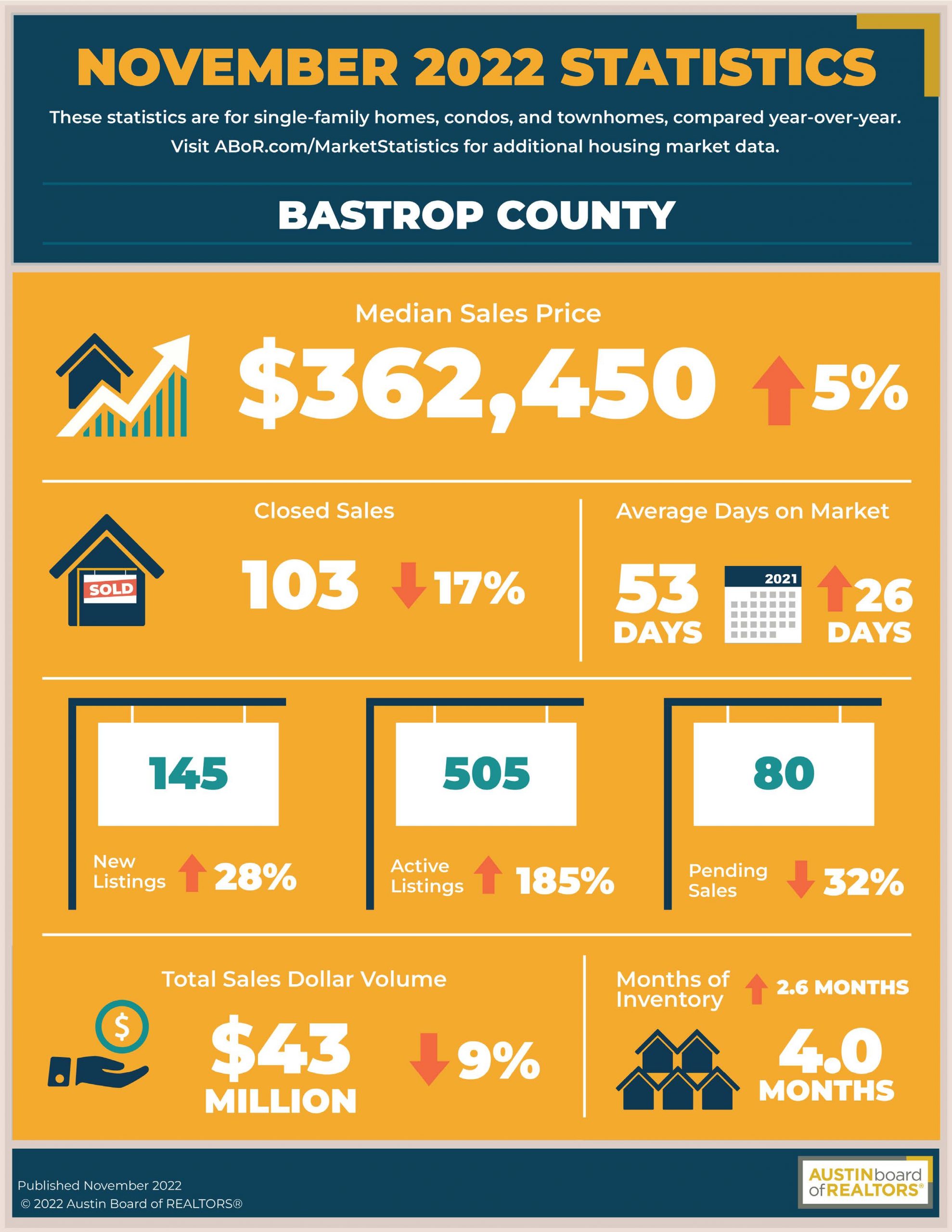

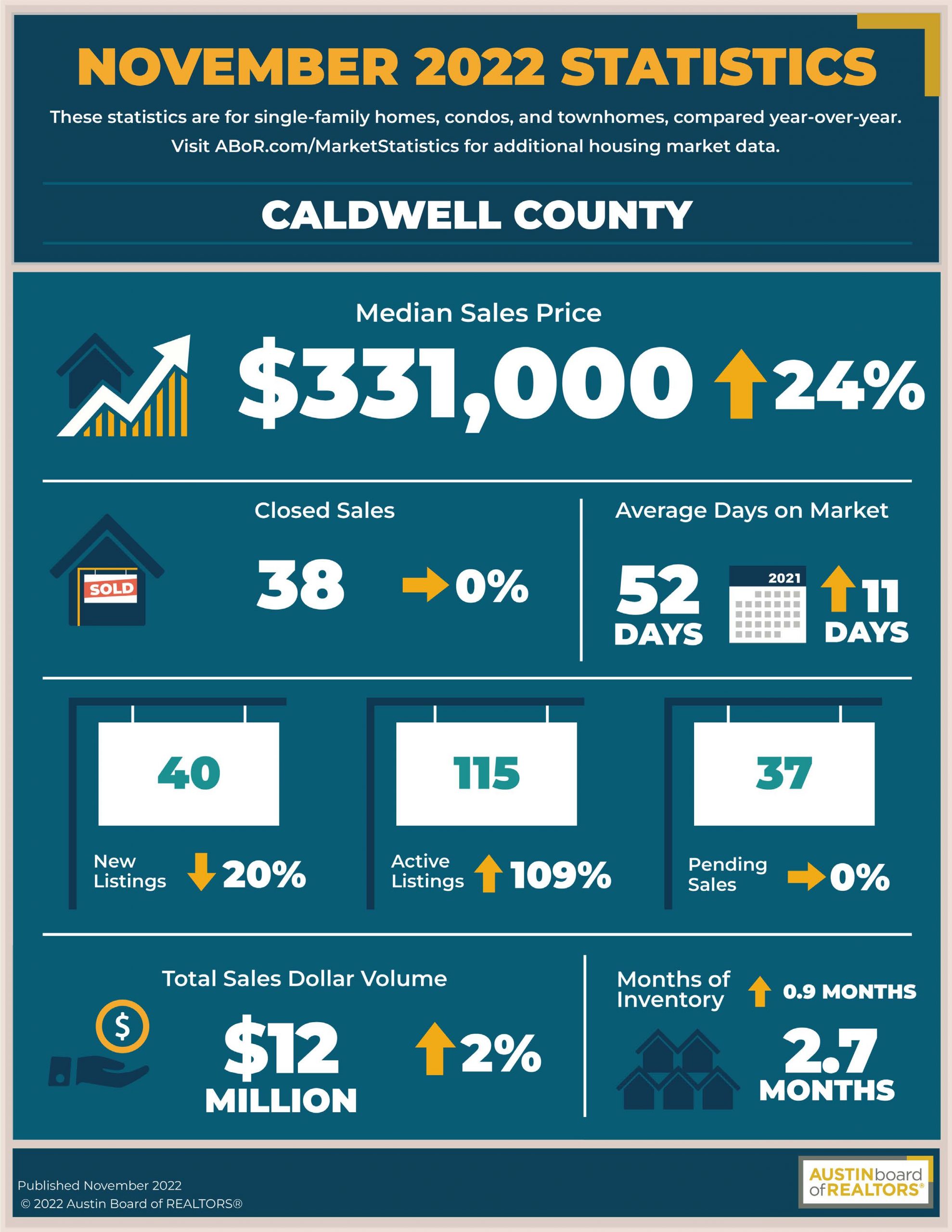

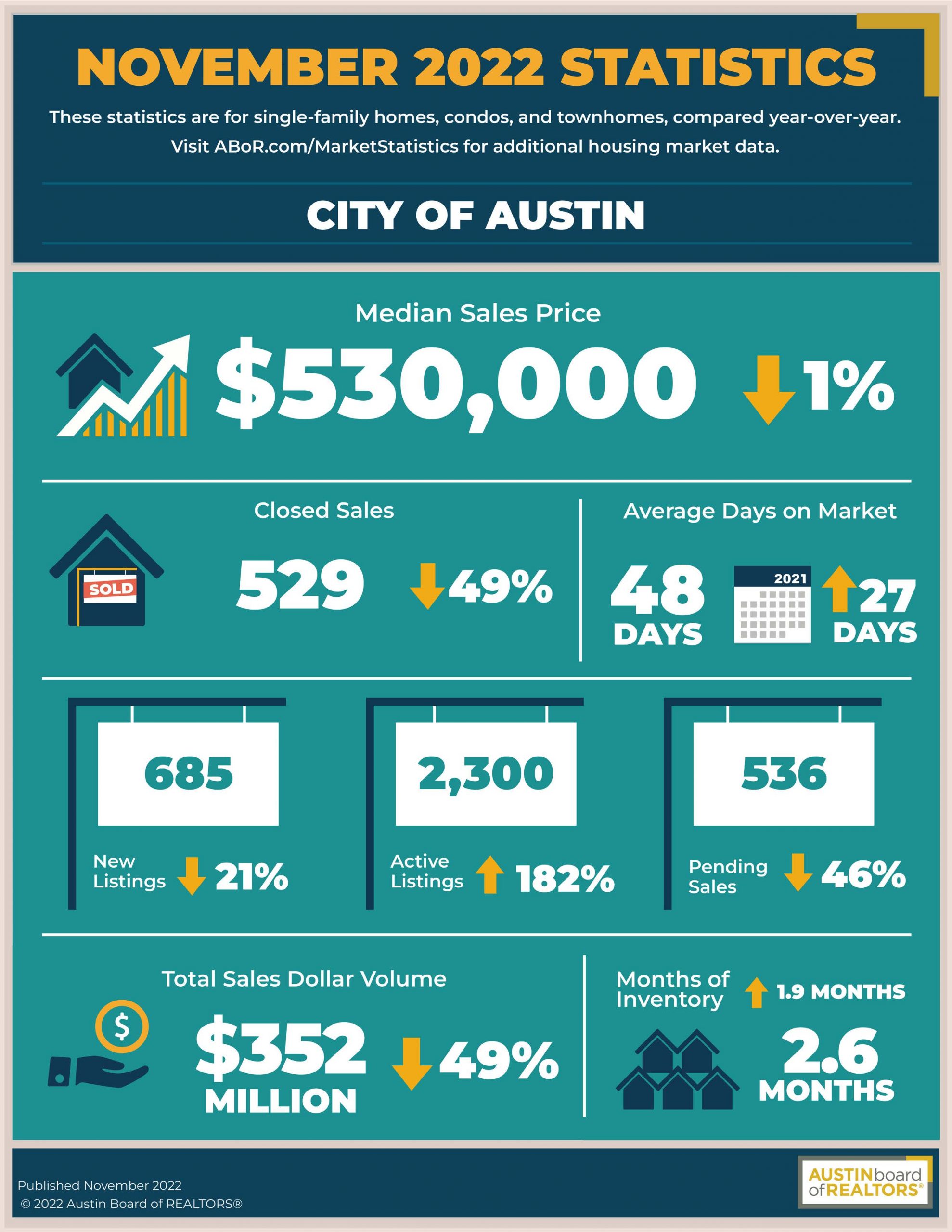

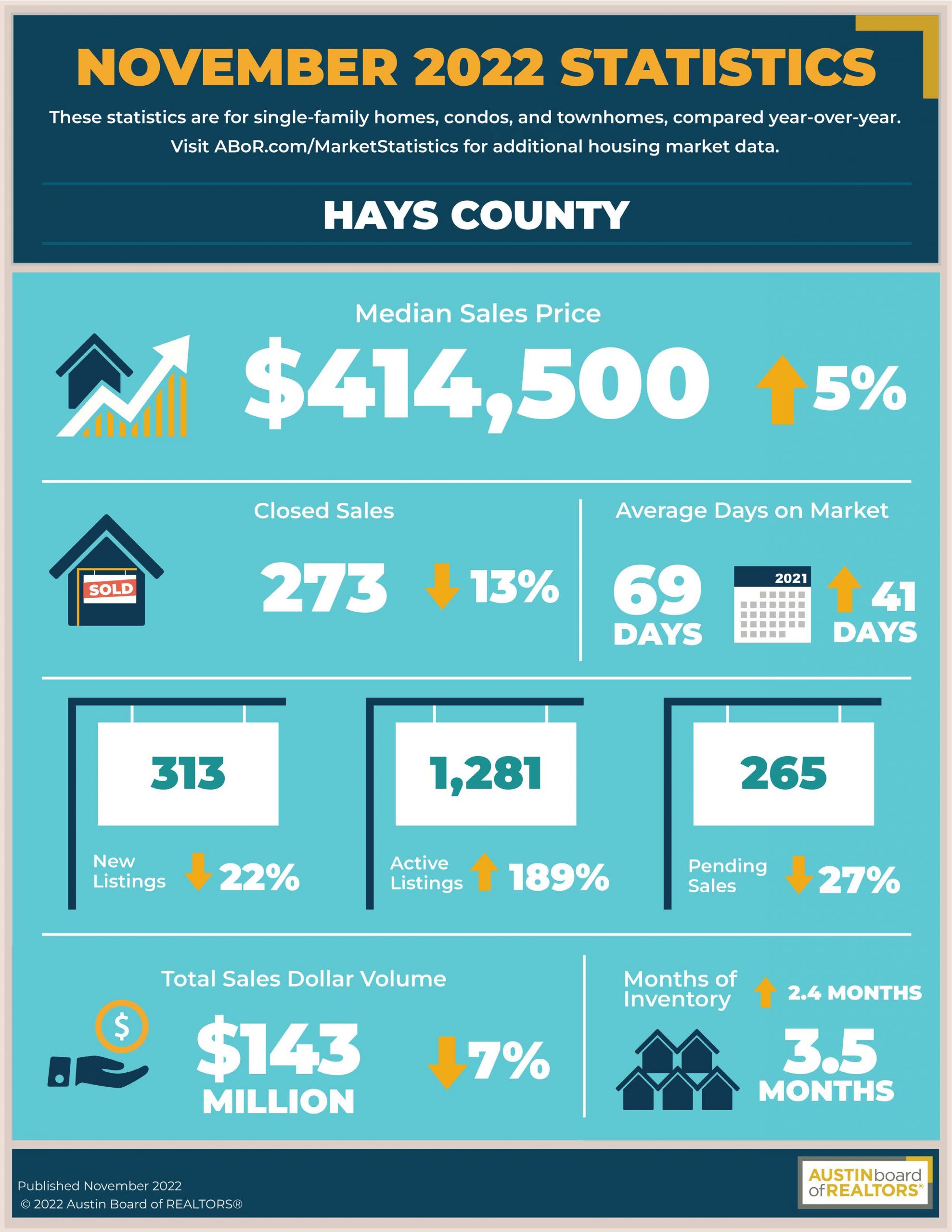

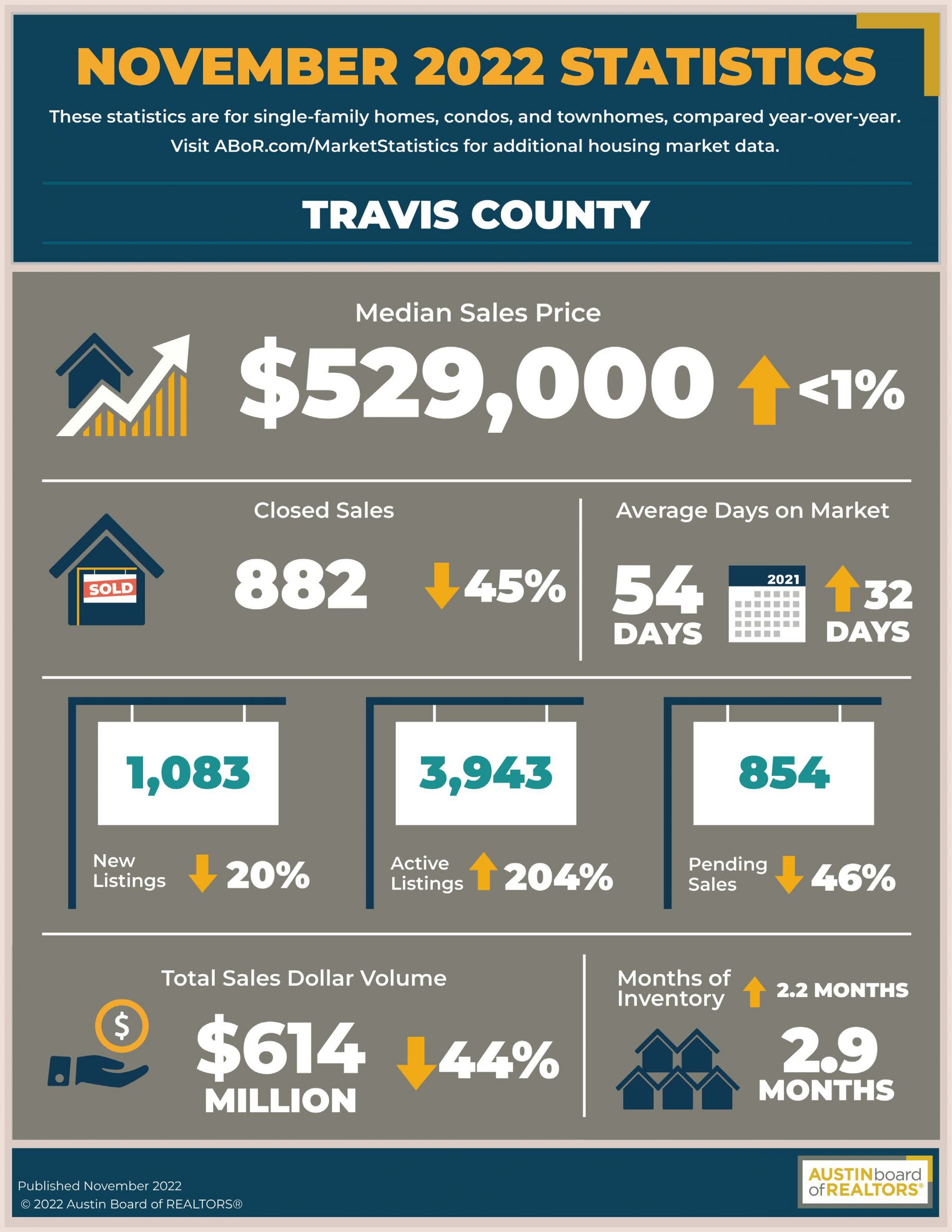

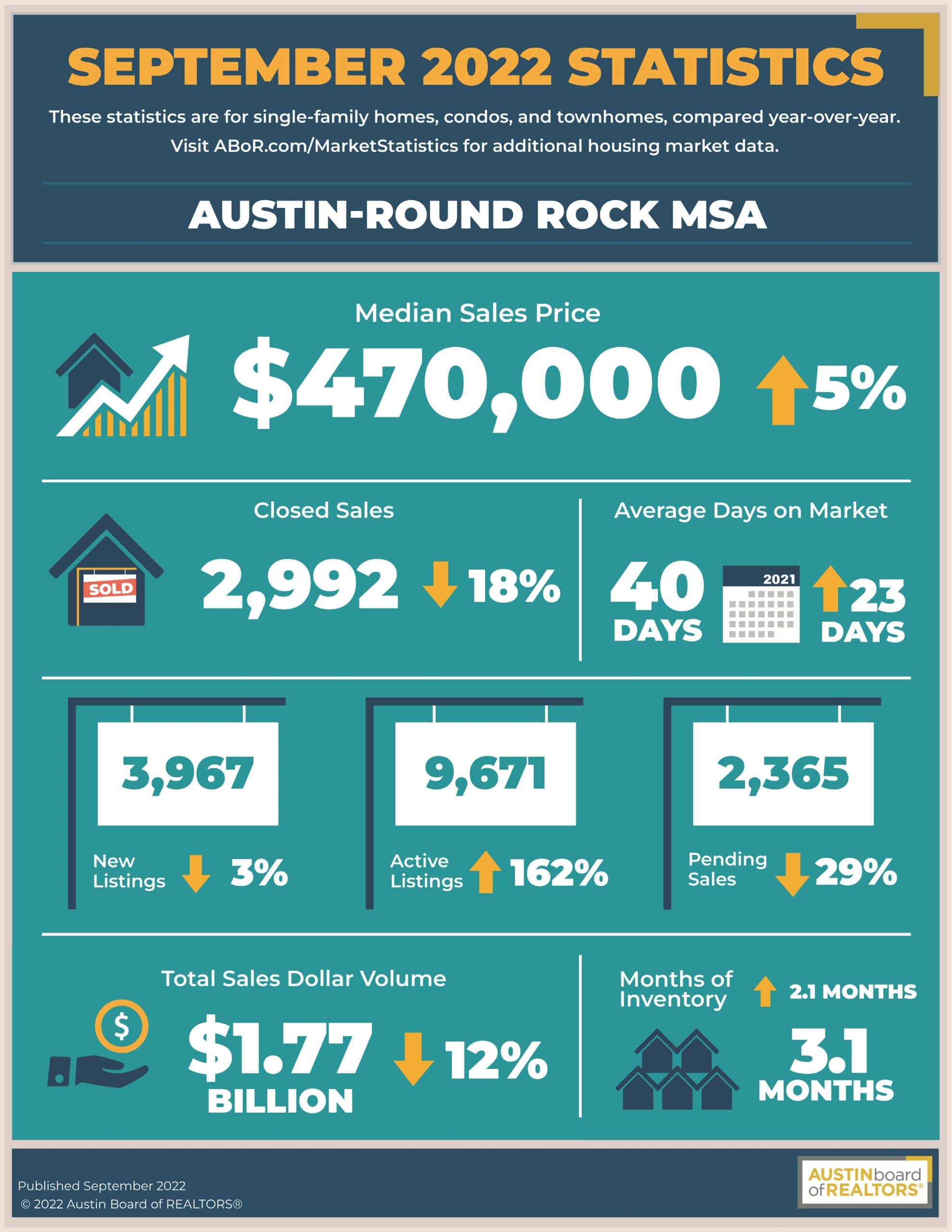

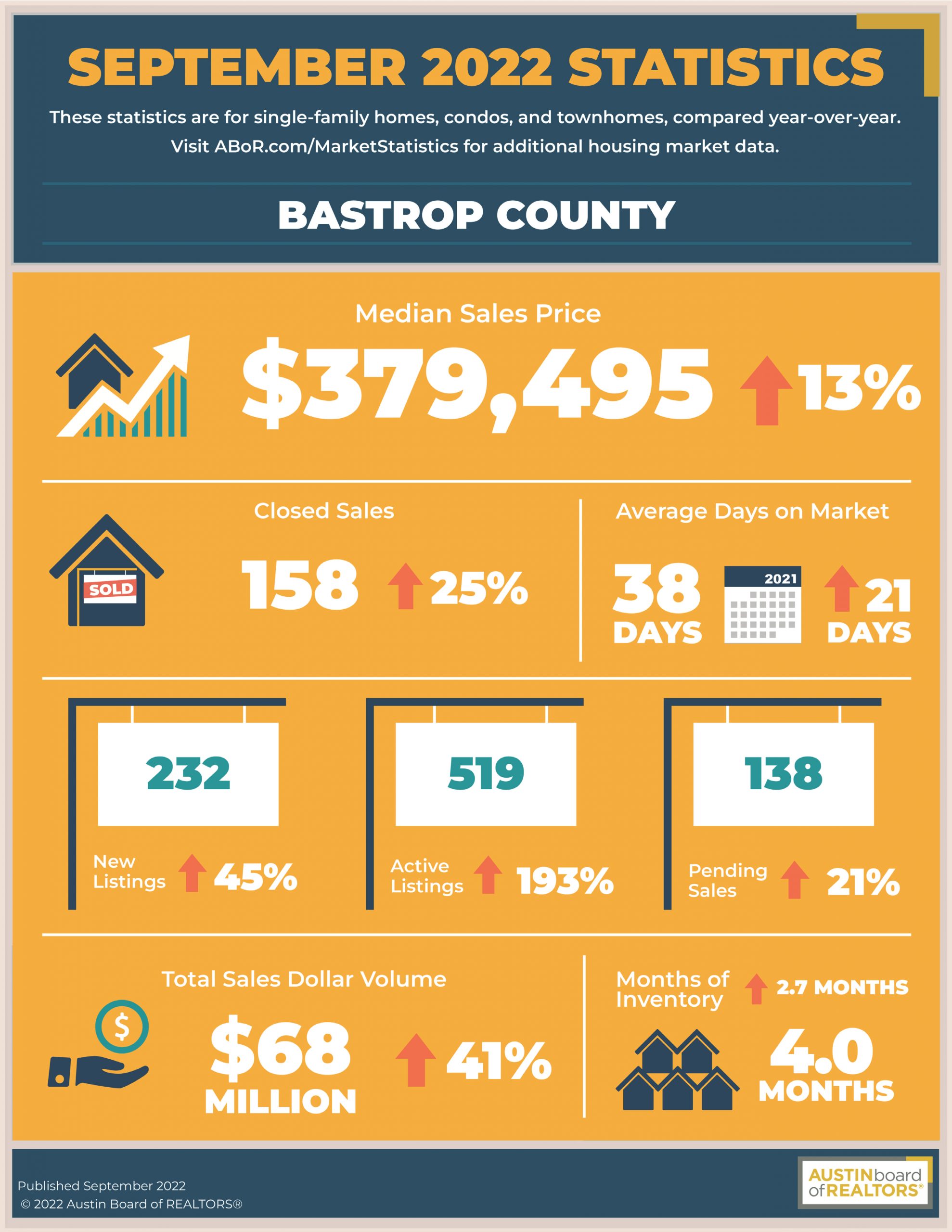

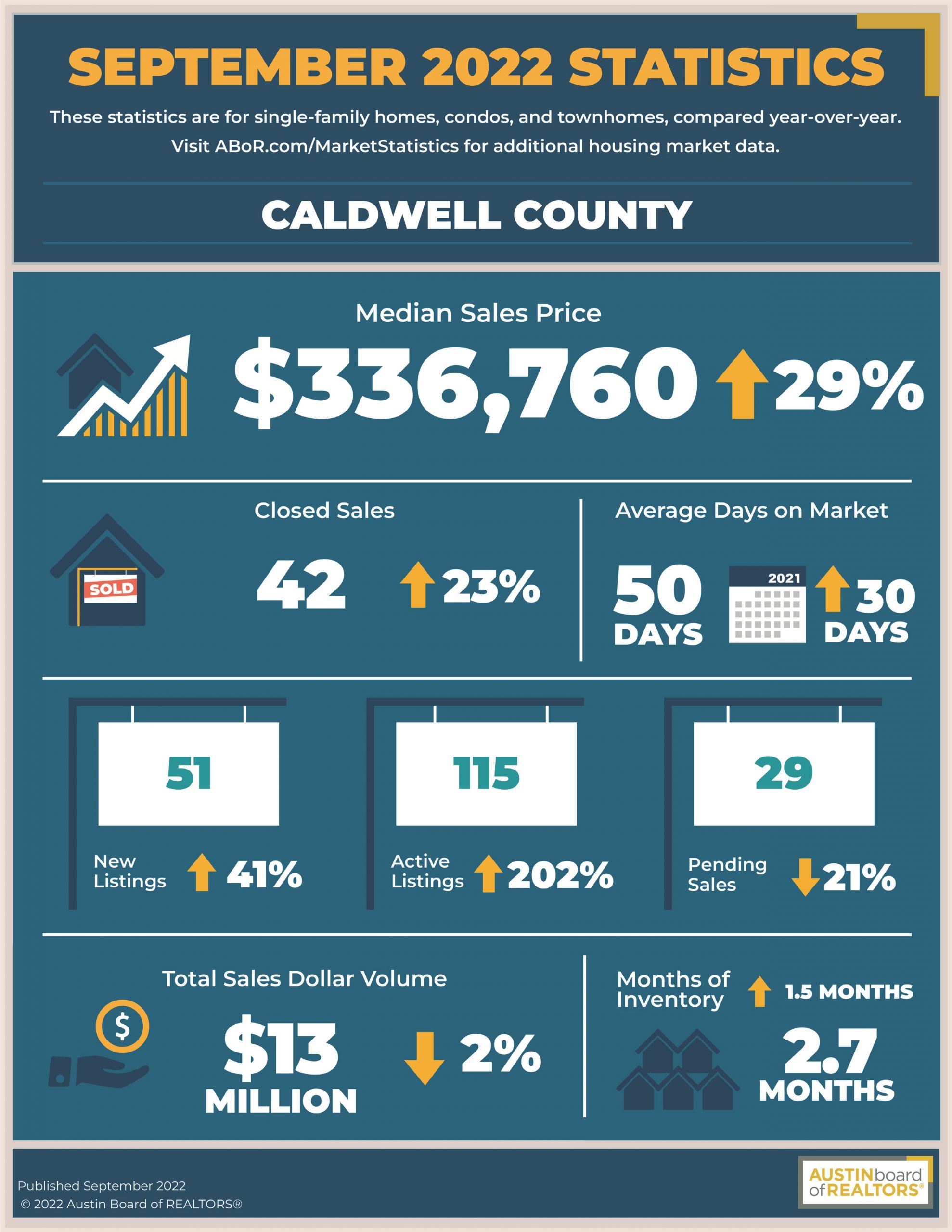

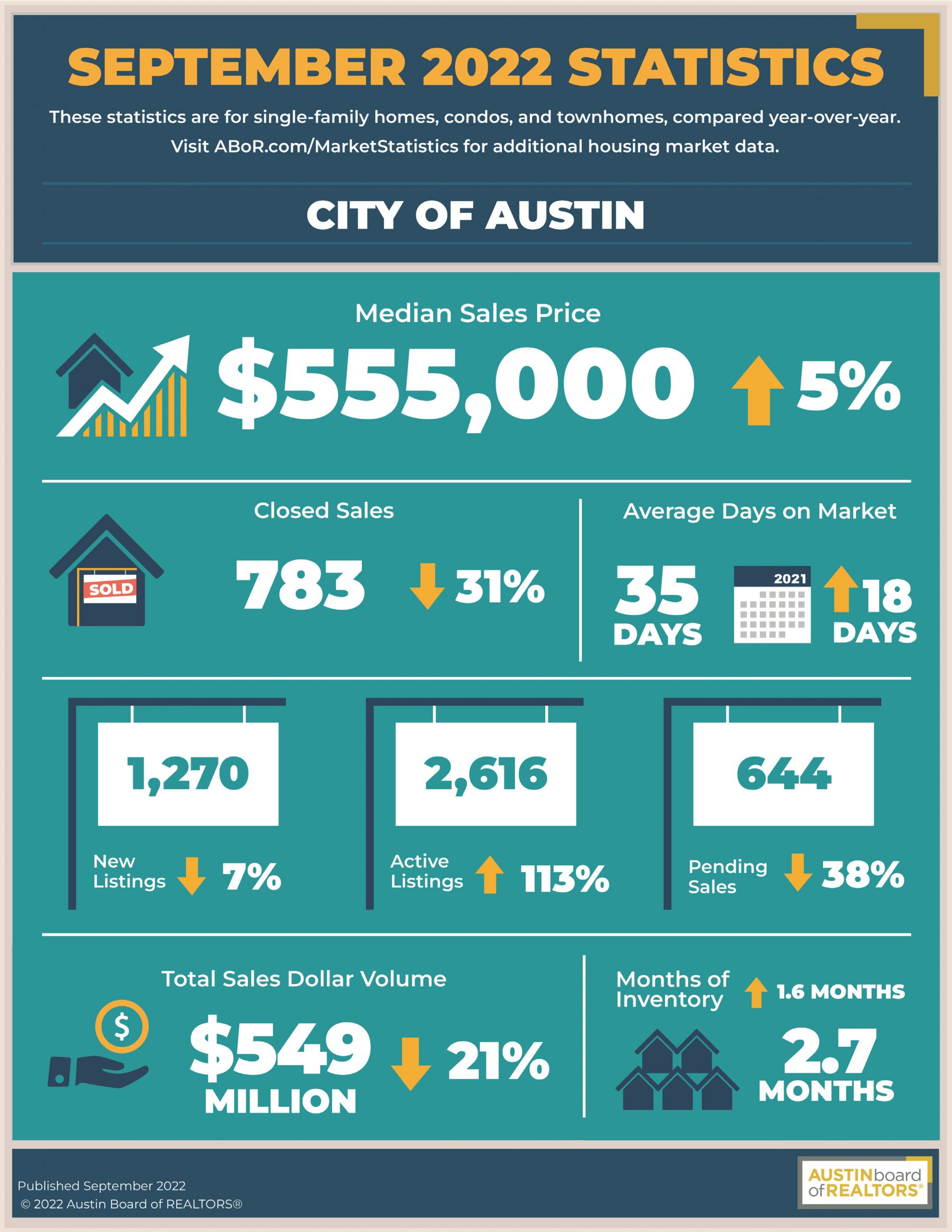

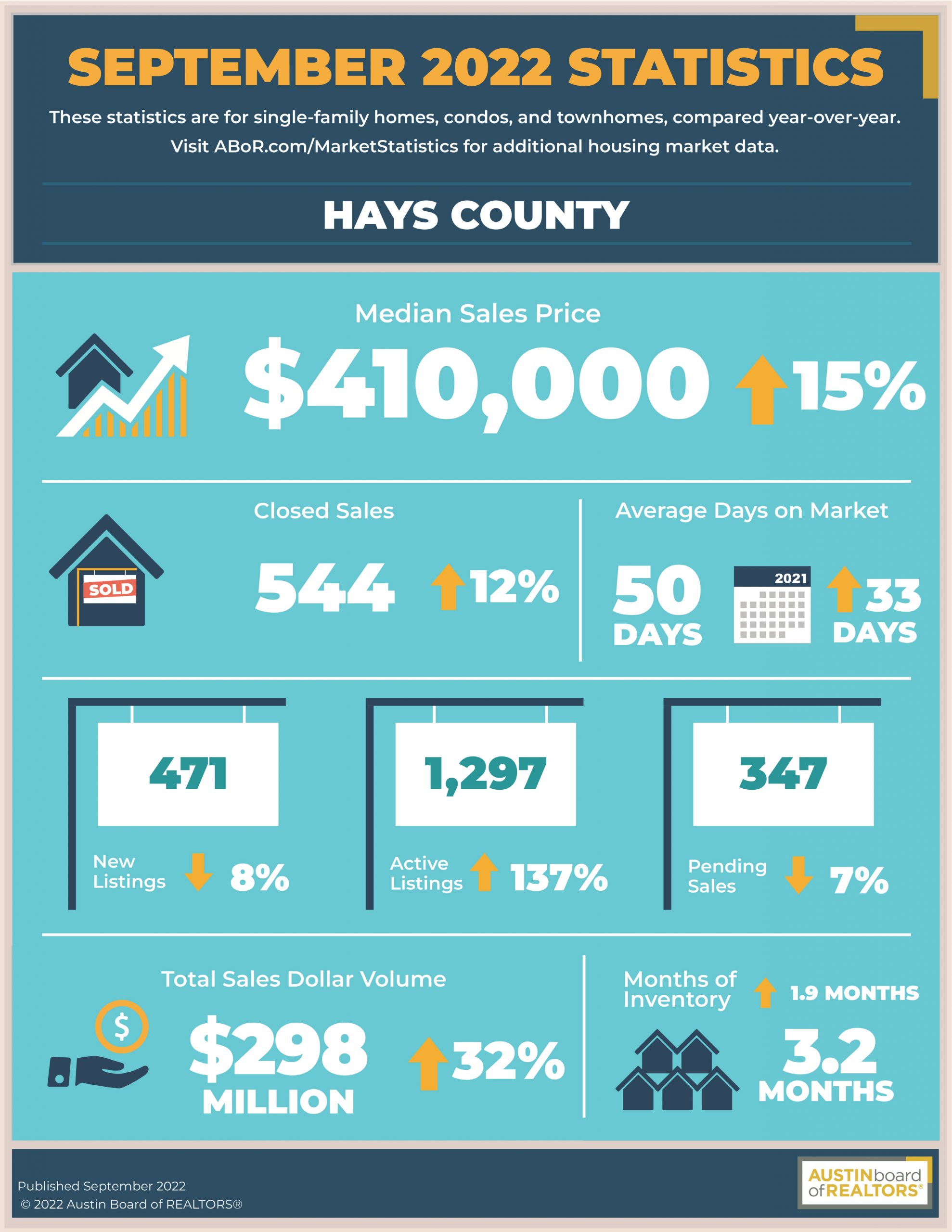

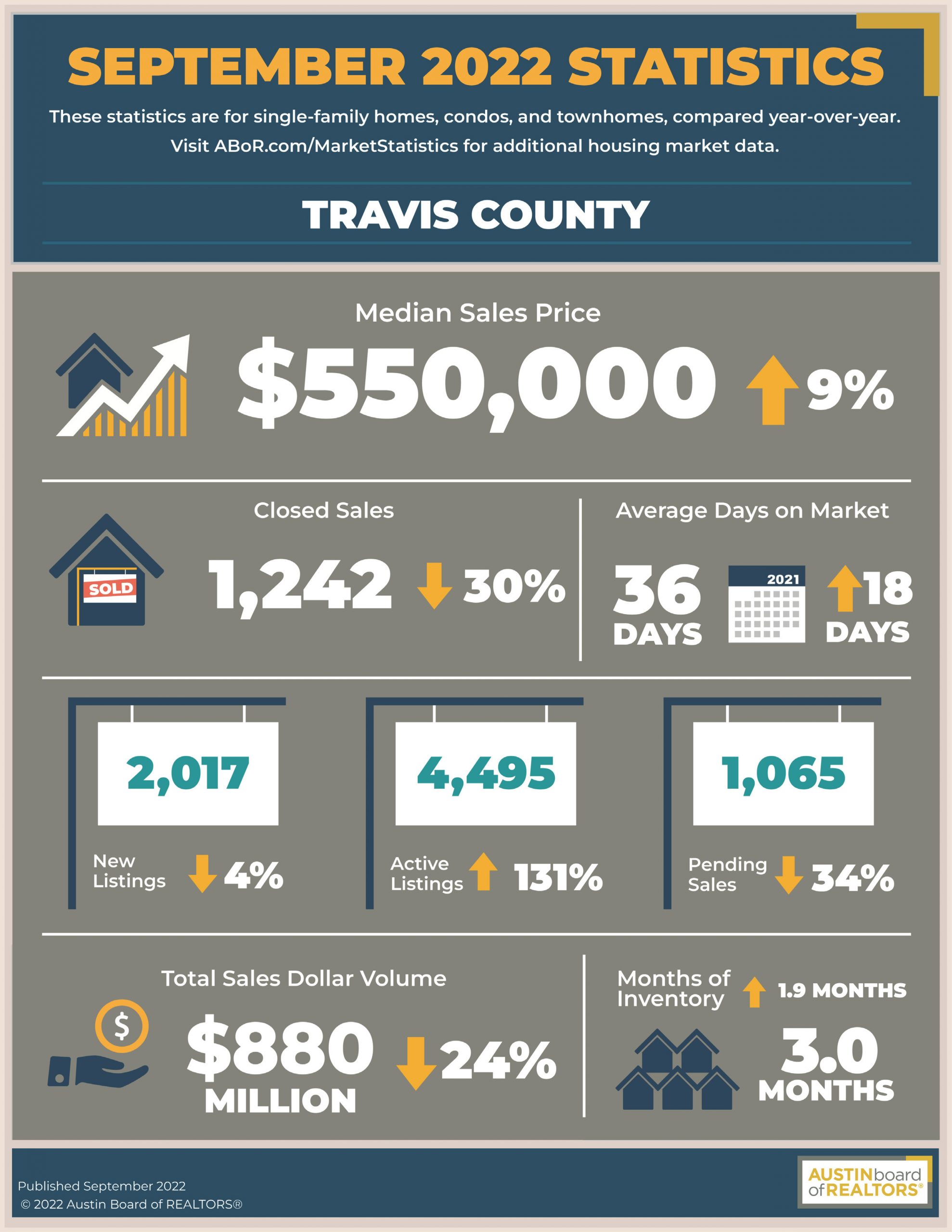

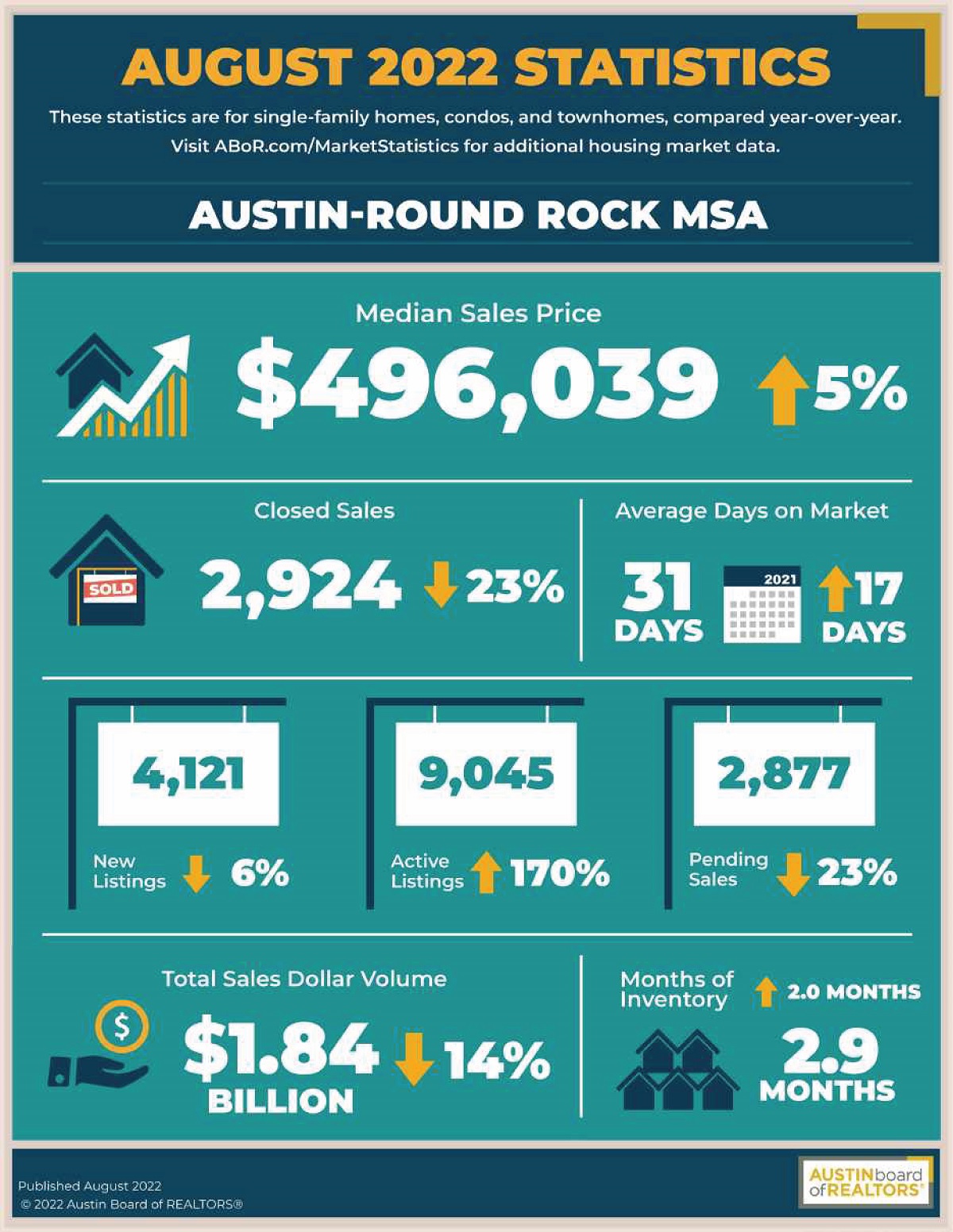

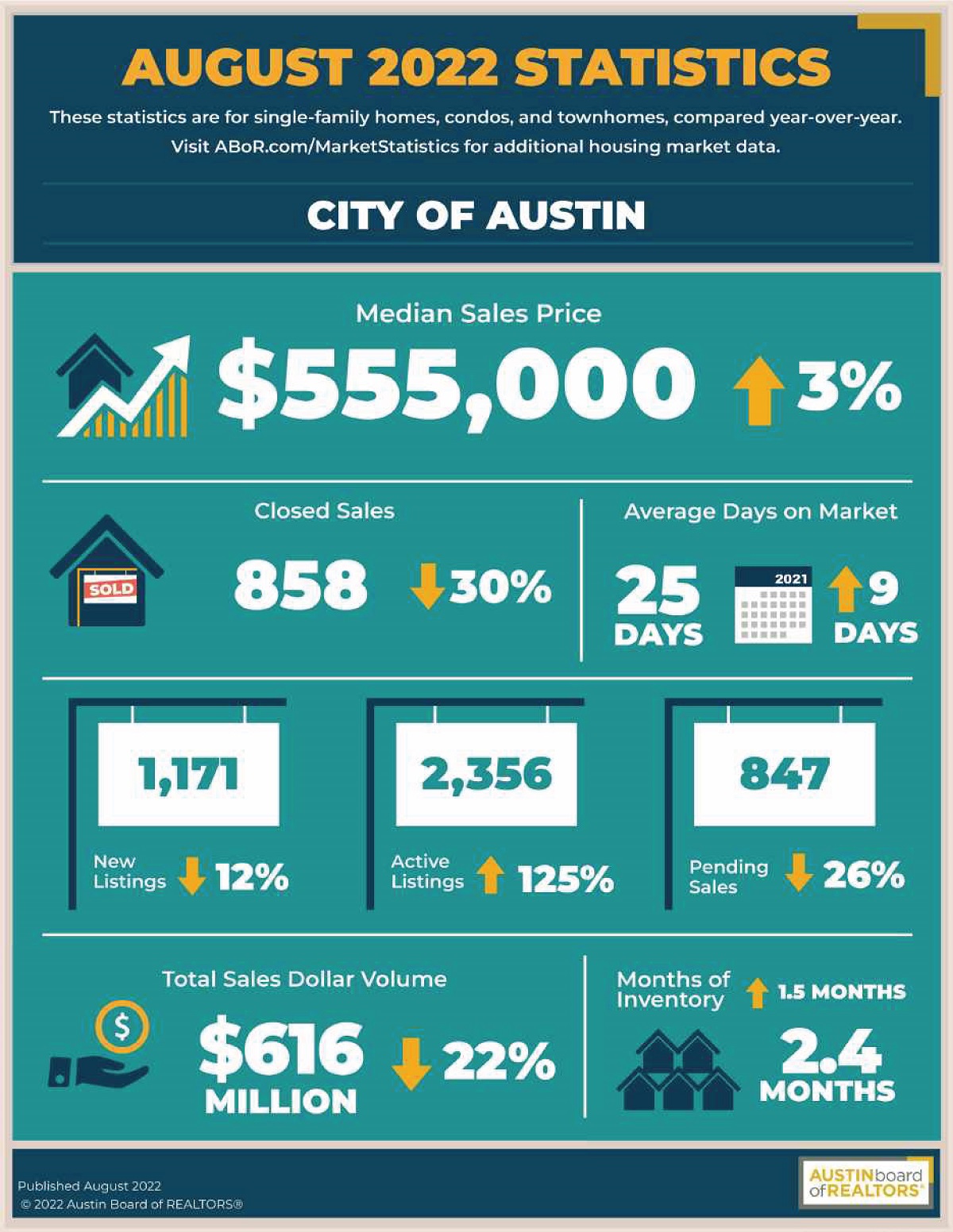

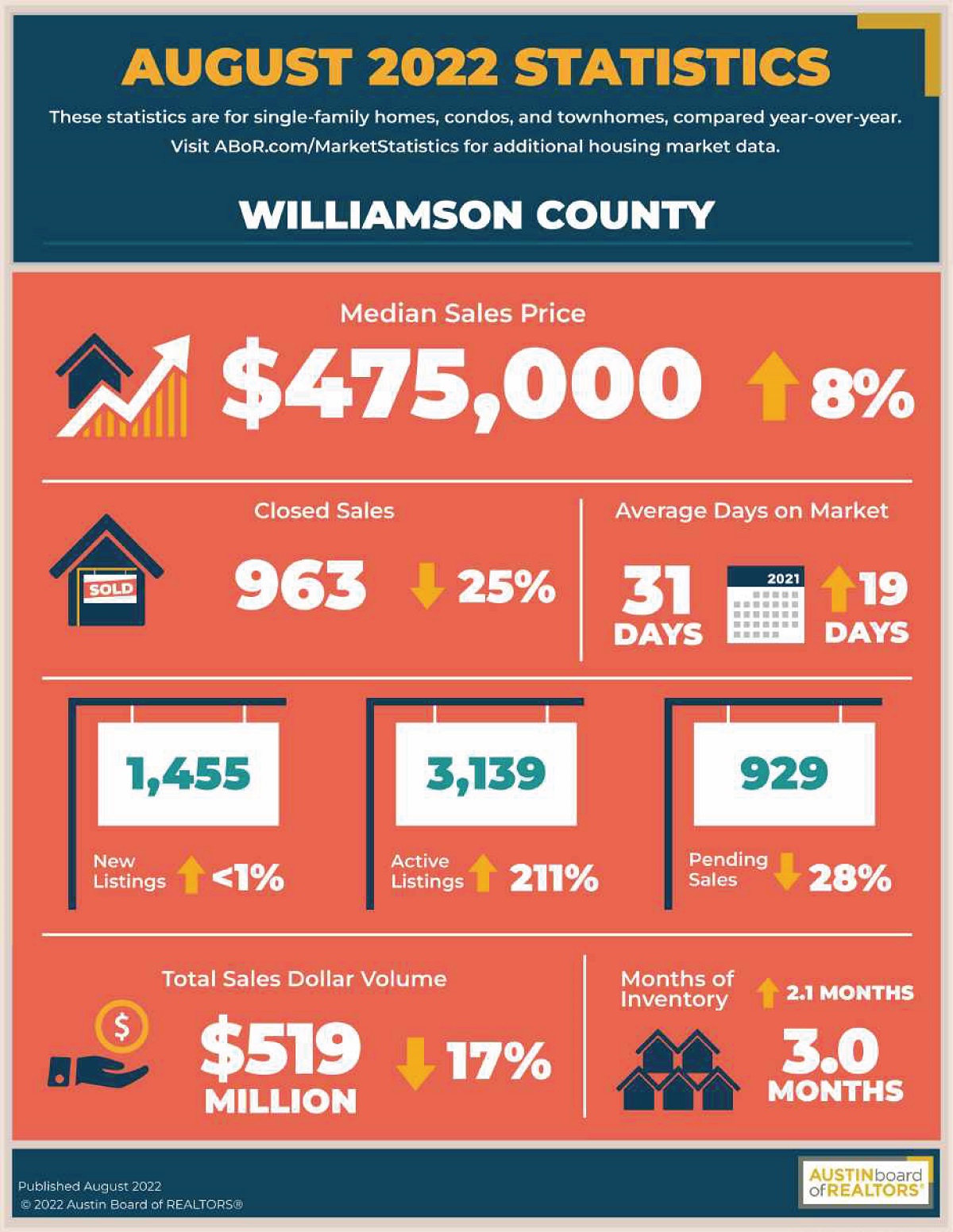

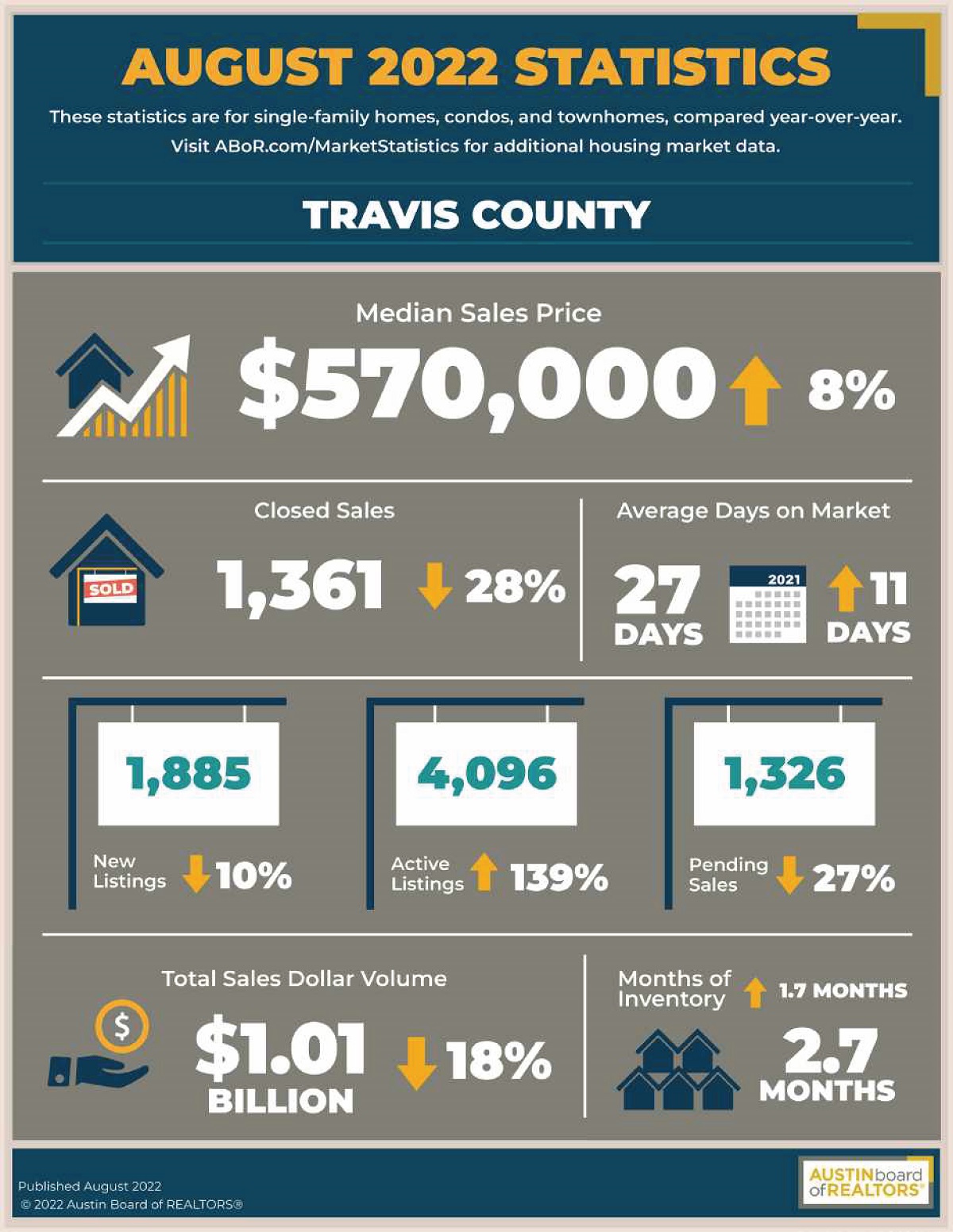

Many home prices are being reduced most everywhere

This past spring and summer saw a frenzy of people wanting to buy, resulting in bidding wars and homes being priced way above what they might have been even a year earlier. So while you won’t get a super-low fixed mortgage right now, you will likely save many thousands of dollars on the house’s price. And if you review mortgage rates over the last 25 years, 7% is close to average.

Owning will almost always beat renting

Unlike the housing market, which has cooled, the rental market is still extremely hot. Paying thousands a month for an apartment builds net worth only for the landlord. Writing mortgage payment checks builds your net worth via the equity owned on the property. Unless you have a really low rent it’s better to own, assuming you can afford it.

Tax benefits are significant for homeowners

It’s been called the best tax break in America–being allowed to deduct mortgage interest paid on federal taxes, assuming you itemize. Since it’s almost all interest paid for the early years of a mortgage, the savings can be significant. With a $200,000 mortgage at 5%, it’s roughly $9,000 interest for years.

Refinancing will likely be an option within a few years

Everyone wants a great mortgage rate, but like the stock market there’s no knowing which way it will trend year to year. While rates are higher now at close to 7% than they’ve been all year, they may go even higher…or lower. Locking in now doesn’t mean you can’t refinance if they go down. You can also consider an adjustable-rate mortgage, which typically has lower rates than the 30-year fixed..

More houses are available with less stress

Buying a house is the biggest purchase most people will ever undertake. For most of 2022 people were having to make lightning-fast decisions, and often were not able to even revisit a house for sale they liked because many were sold within days of being listed. It’s normalizing in many markets, where you can take your time before putting a bid in. That’s the rational way to go about it.