The worst thing clients can do presently is wait to see if rates dip.

5 Things New Homeowners Waste Money On

|

Mid-Year Market Update

|

Why the Median Home Price Is Meaningless in Today’s Market

The National Association of Realtors (NAR) will release its latest Existing Home Sales (EHS) report later this week. This monthly report provides information on the sales volume and price trend for previously owned homes. In the upcoming release, it’ll likely say home prices are down. This may feel a bit confusing, especially if you’ve been following along and seeing the blogs saying that home prices have bottomed out and turned a corner.

So, why will this likely say home prices are falling when so many other price reports say they’re going back up? It all depends on the methodology of each report. NAR reports on the median sales price, while some other sources use repeat sales prices. Here’s how those approaches differ.

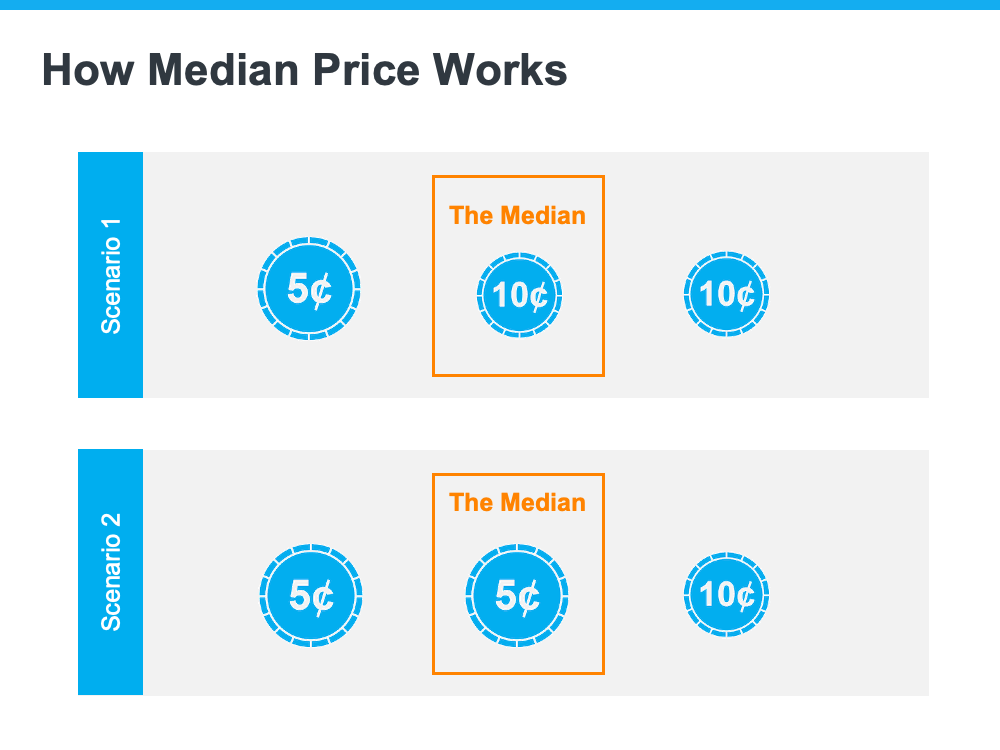

The Center for Real Estate Studies at Wichita State University explains median prices like this:

“The median sale price measures the ‘middle’ price of homes that sold, meaning that half of the homes sold for a higher price and half sold for less . . . For example, if more lower-priced homes have sold recently, the median sale price would decline (because the “middle” home is now a lower-priced home), even if the value of each individual home is rising.”

Investopedia helps define what a repeat sales approach means:

“Repeat-sales methods calculate changes in home prices based on sales of the same property, thereby avoiding the problem of trying to account for price differences in homes with varying characteristics.”

The Challenge with the Median Sales Price Today

As the quotes above say, the approaches can tell different stories. That’s why median price data (like EHS) may say prices are down, even though the vast majority of the repeat sales reports show prices are appreciating again.

Bill McBride, Author of the Calculated Risk blog, sums the difference up like this:

“Median prices are distorted by the mix and repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices.”

To drive this point home, here’s a simple explanation of median value (see visual below). Let’s say you have three coins in your pocket, and you decide to line them up according to their value from low to high. If you have one nickel and two dimes, the median value (the middle one) is 10 cents. If you have two nickels and one dime, the median value is now five cents.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change.

That’s why using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now. Most buyers look at home prices as a starting point to determine if they match their budgets. But, most people buy homes based on the monthly mortgage payment they can afford, not just the price of the house. When mortgage rates are higher, you may have to buy a less expensive home to keep your monthly housing expense affordable. A greater number of ‘less-expensive’ houses are selling right now for this exact reason, and that’s causing the median price to decline. But that doesn’t mean any single house lost value.

When you see the stories in the media that prices are falling later this week, remember the coins. Just because the median price changes, it doesn’t mean home prices are falling. What it means is the mix of homes being sold is being impacted by affordability and current mortgage rates.

Bottom Line

For a more in-depth understanding of home price trends and reports, let’s connect.

Should You Reduce Your Listing Price after Two Weeks in the Current Market, or Is That Too Soon?

Over the past few years, homeowners have gotten used to the idea that pretty much every house sells quickly and for over the asking price. Houses were selling in such record time that most sellers never even had to consider the thought of reducing their price.

But the market has changed recently, due in large part to mortgage rates rising considerably. This has priced some buyers completely out of the market, made others hesitant to buy, and reduced the buying power of those who are still ready, willing, and able to buy a house.

So, depending upon your area and price range, your house might not sell in the first couple of weeks, let alone the first few days of it being on the market. Not that a couple of weeks is all that long to sell your house from a historical perspective; houses can take months to sell in some markets.

Regardless of whether it’s a fast-paced market like we’re coming out of, or one where it takes months for a house to sell, many people would think reducing the price of a house after just a couple of weeks on the market sounds a bit too soon and unreasonable. But if you’re selling your house and haven’t gotten an acceptable offer in the first two weeks, there’s a good chance your agent will suggest that you reduce your price… and for good reason.

Why Do Agents Suggest Reducing Your Price After Just Two Weeks?

Every agent, market, and situation are different, so it’s not definite that your agent will suggest reducing your listing price after two weeks. However, it’s a fairly common amount of time for agents to give a listing a fair test run and assess how the market reacted.

The reasoning is that the first two weeks are when you’ll see the highest amount of activity from buyers. Serious buyers, people who are just thinking about buying, and nosy neighbors all flock to new listings when they first hit the market.

But the serious buyers are the ones who truly matter. They’re the most informed about what’s on the market, how one house compares to another, and ultimately whether something is worth what the seller is asking. And most importantly, they’re ready and anxious to make an offer immediately on a house they like so they don’t lose it to another buyer, regardless of whether the pace of the market is fast, slow, or somewhere in between.

So, if you go a couple of weeks and none of the serious buyers in your area and price range have made an offer, that’s a pretty good sign that the buyers don’t feel like your house is worth the price you’re asking, and why your agent might suggest reducing the price.

Things to Consider if Your Agent Is Suggesting a Price Reduction

Trust your agent’s expertise and advice, it can be difficult for some sellers to understand what their agent is basing their suggestion upon, other than it just being on the market for two weeks without selling. While the two-week rule of thumb has a solid basis, you should also consider a few other factors that your agent likely takes into account, before you decide whether or not to reduce the price of your house.

Here are some questions to help you have an educated discussion with your agent, and make a well-informed decision:

- Were there offers being made on other competing houses? If so, that’s a definite sign that buyers are actively making offers but chose another house over yours. This is difficult to ascertain at times, because offers being made aren’t typically trackable. But agents often have a handle on which houses are receiving offers due to interacting with other local agents.

- Did anything else in your area and price range go under contract? Receiving offers is one thing, but accepting one is another. If any house you’re competing with actually goes under contract, the downside is that one of your potential buyers is now gone. On the flip side, one of the houses you’re competing with is gone, too. You’ll need to weigh both of those things in your decision to reduce your price or not.

- Were the competing houses that buyers made offers on better than yours? Honesty can be hard, but make sure that the houses you’re assessing against truly were similar in size, condition, and location to yours. It’s easy to put blinders on and feel like your house is the greatest one on the market, but it helps if you can be as objective as possible.

- Was your house priced appropriately to begin with? It won’t do you any good to assess the market activity if your house isn’t even in the proper market price point. If your agent originally suggested a lower listing price based upon their comparative market analysis (CMA) and you opted to list your house for a higher amount, then you should consider reducing your price to the one they initially suggested.

- Has the market changed since you first decided upon a list price? Whether you listed at the price your agent originally suggested or not, consider whether the market has changed since you originally discussed and decided upon your list price. The real estate market doesn’t typically have drastic ups and downs like the stock market, but it can change enough in a short period of time to impact the activity you expected, or the appropriateness of your price.How Much Should You Reduce the Price?There’s no way to say that a certain percentage price reduction is appropriate for every single seller in every single situation. It boils down to reducing it enough to get the attention of the current buyers in the market and make them feel the need to act before it’s too late. Doing that is as much art as it is data-driven science…

…which is why you should ultimately trust the judgment and advice of your agent — who knows the local market, your particular home, and your situation — about when to reduce, and how much to reduce the price of your house.

The Takeaway:

In many areas and price ranges, houses aren’t selling as quickly as they were in recent years. Many houses were selling well before being on the market for two weeks, which is about the timeframe when agents suggest reducing the asking price if there haven’t been any acceptable offers.

Even though two weeks might not sound like enough time on the market before reducing your price, it’s enough time to assess whether or not your price is appropriate. If your agent is suggesting a price reduction after two weeks, be open to an objective discussion about the reasons you should consider doing so.

Why You Need A REALTOR® to Sell Your Home

With so much at stake in the selling of a home, here’s why you should work with a skilled professional list and sell your home.

For many people, owning a home is one of the largest financial transactions they’ll make, which is why 87% of sellers rely on an agent to be their guide. It’s estimated that real estate agents play more than 150 roles during an average home transaction, so it’s best to leave it to the pros.

- Expertise and Experience: REALTORS® are professionals who have specialized knowledge and experience in the real estate market. They understand the complexities of the selling process, including pricing, marketing, negotiating, and legal requirements. Their expertise can help you navigate through potential pitfalls and ensure a smooth transaction.

- Pricing Strategy: Determining the right price for your home is crucial to attract potential buyers while maximizing your returns. REALTORS® have access to extensive market data, including recent sales and comparable properties, which enables them to assess the value of your home accurately. They can help you set a competitive price that aligns with the market conditions and your goals.

- Marketing and Exposure: REALTORS® have a wide range of marketing tools and resources at their disposal to promote your property effectively. They can create professional listings, showcase your home through high-quality photographs and virtual tours, advertise it on multiple listing services (MLS), and leverage their network and connections to reach a broader pool of potential buyers. This increased exposure can lead to more showings and ultimately a faster sale.

- Negotiation Skills: Negotiating with buyers can be a complex and emotionally charged process. REALTORS® are skilled negotiators who can represent your interests and help you secure the best possible deal. They understand market trends, buyer motivations, and effective negotiation strategies, allowing them to navigate offers, counteroffers, and contingencies to achieve favorable outcomes.

- Time and Convenience: Selling a home requires a significant investment of time and effort. By working with a REALTOR®, you can offload many tasks and responsibilities to them. They handle inquiries, schedule showings, facilitate open houses, and coordinate with potential buyers and other parties involved in the transaction. This saves you valuable time and allows you to focus on other priorities in your life.

- Professional Network: REALTORS® have established relationships with a network of professionals in related fields, such as mortgage brokers, home inspectors, appraisers, and attorneys. They can provide recommendations and connect you with trusted professionals who can assist with various aspects of the selling process. This network can streamline the process and ensure that all necessary steps are completed efficiently.

- Legal Protection: Selling a home involves legal contracts, disclosures, and other paperwork that must comply with local regulations. REALTORS® are well-versed in these requirements and can help you navigate the legal aspects of the transaction. They can ensure that all necessary documents are prepared correctly, review contracts on your behalf, and safeguard your interests throughout the process.

While it is possible to sell a home without a REALTOR®, leveraging their expertise and services can significantly enhance your chances of achieving a successful sale at the best possible terms and price.

If you are selling your property and plan to purchase another home, your real estate agent will be a valuable partner to help ensure everything goes smoothly. In fact, 53% of sellers nationwide use the same agent to purchase their next home.

Contact me today to discuss listing your property for this selling season. I can help!

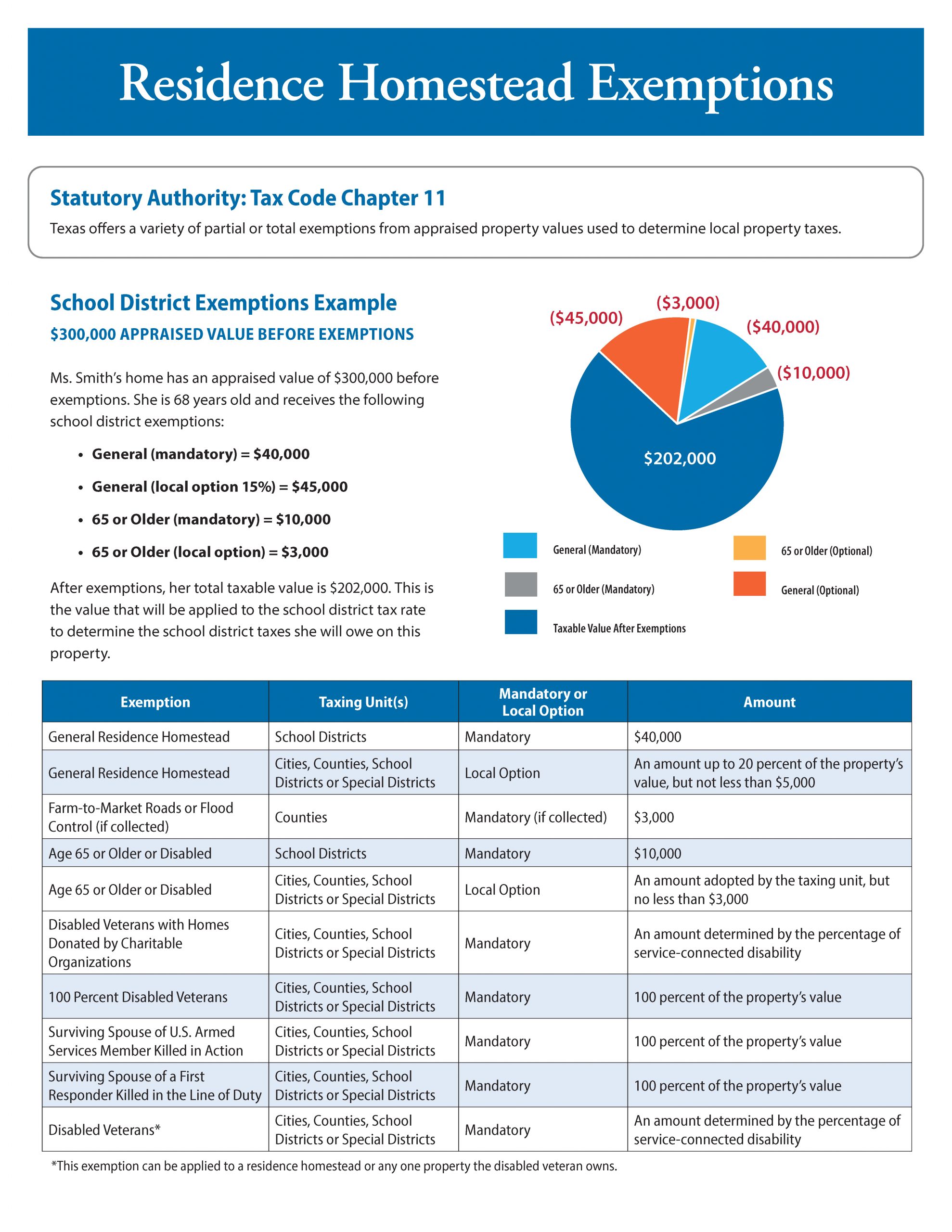

Homestead Exemptions – 2023 Time to File

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

1. New Furniture and Decor

1. New Furniture and Decor