If you purchased a home in 2022, it is time to file your HOMESTEAD EXEMPTION. It is free and most of the time, you can do it online.

If I can be of service or answer questions, please reach out!

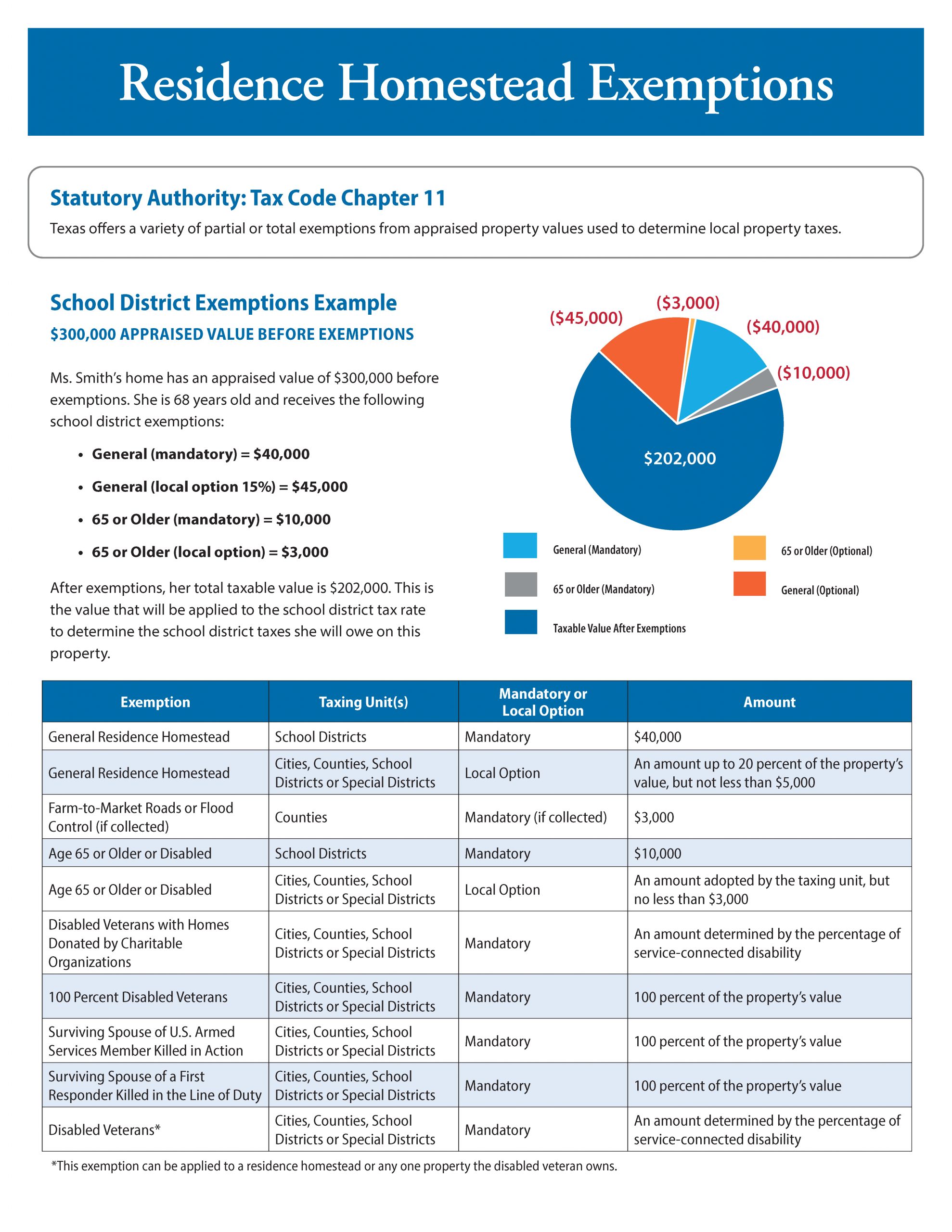

Homestead exemptions remove part of your home’s value from taxation, so they lower your taxes.

– All residence homestead owners are allowed a $40,000 exemption from their home’s value for school taxes.

– Individuals aged 65 or older or disabled residence homestead owners qualify for an additional $10,000 exemption.

For a complete list of additional exemptions, qualifications and applications visit the links below:

Travis County – https://traviscad.org/homesteadexemptions

Williamson County – https://www.wcad.org/forms-and-applications

Bastrop County – https://bastropcad.org/before-you-continue-hs

Hays County – https://hayscad.com/forms

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link