Here are some of the biggest misconceptions about today’s housing market and the facts.

#1: WE’RE IN A HOUSING BUBBLE

Back then, new construction single-family homes flooded the market, lending standards were incredibly loose, and many homeowners were cashing out their equity left and right.

Today’s market is nearly the exact opposite.

Since the housing crash of 2008:

- Lending standards have tightened

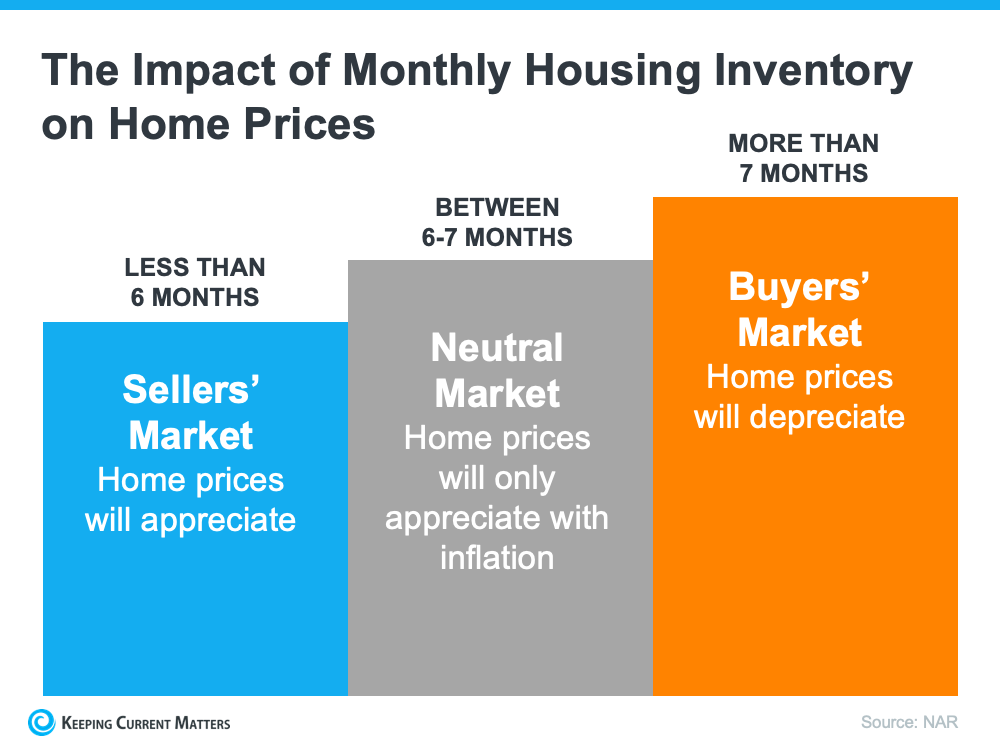

- The market is under-supplied rather than over-supplied on inventory

- Most homeowners are much more cautious with their equity

Plus, housing market experts are forecasting continued price appreciation this year, as demand continues to outweigh home supply.

#2: LOTS OF FORECLOSURES ARE COMING

Stories about the volume of foreclosures are all over the news today. But the most important thing to remember is context is everything.

Yes, many homeowners were able to pause their mortgage payments during the forbearance program, and there was legitimate concern from many experts that it would result in a wave of foreclosures coming to the market.

However, the number of foreclosures we’re seeing today is nothing like the last time.

Here are some of the reasons why that’s happening:

- Most homeowners have enough equity to sell their homes

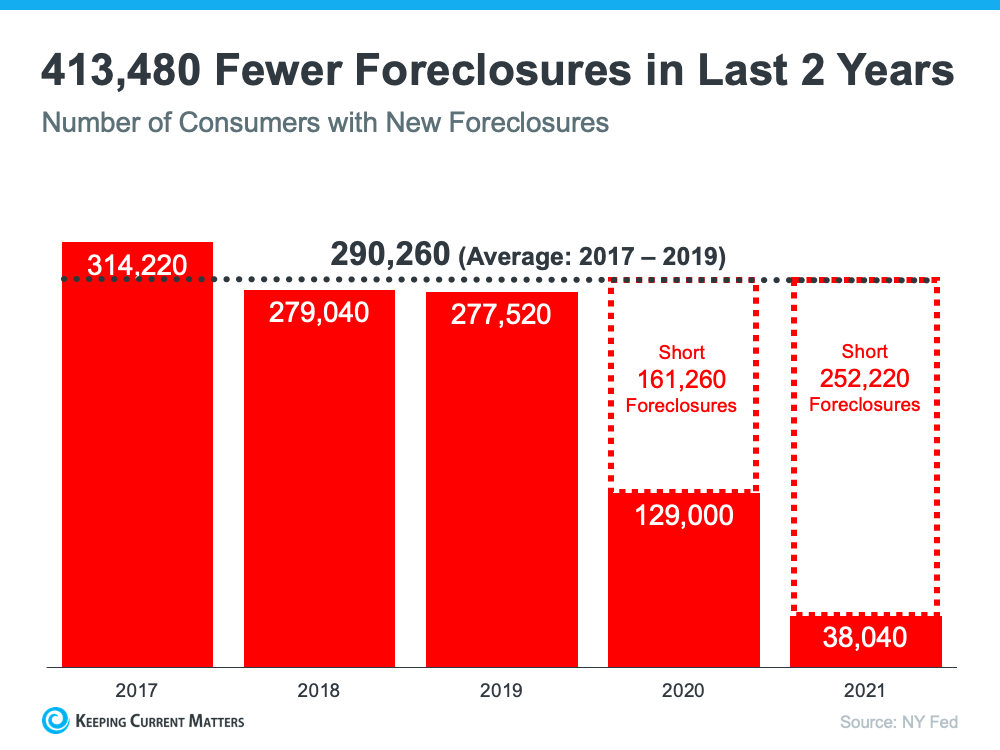

- There have been fewer foreclosures over the last two years

- The current market can easily absorb the new listings

Today’s data shows that most homeowners are exiting their forbearance plan either fully caught up on payments or with a plan from the bank that restructured their loan in a way that allowed them to start making payments again.

For all of these reasons, experts don’t anticipate a wave of foreclosures that would negatively affect housing prices.

#3: HOUSING PRICES WILL DEPRECIATE

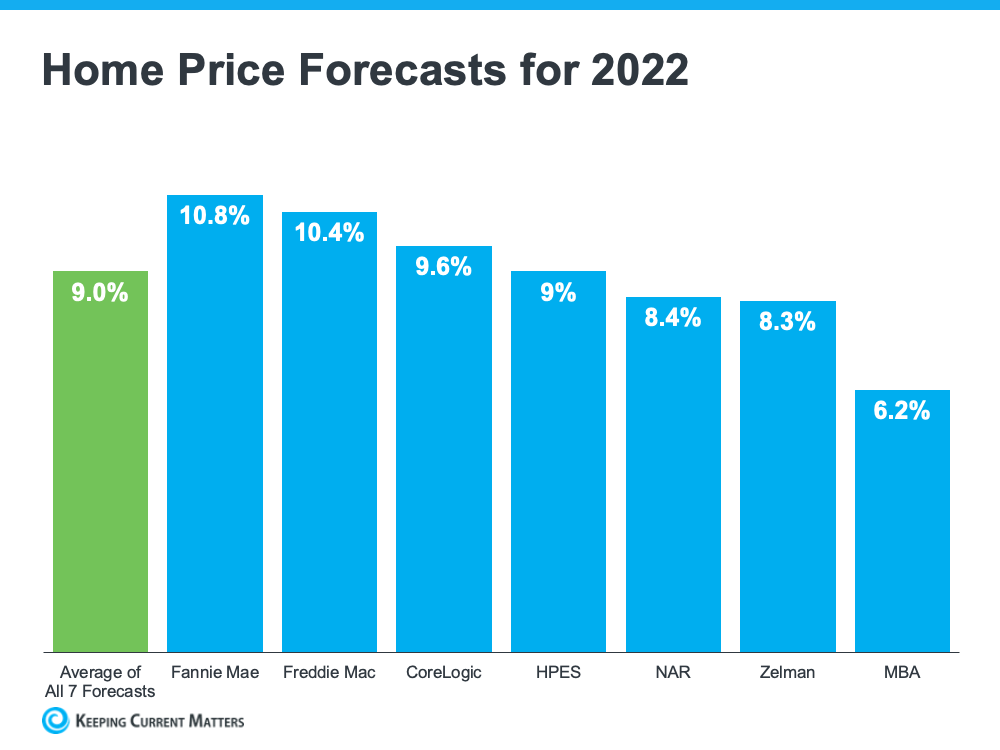

Skyrocketing price appreciation has many sellers and buyers sitting on the fence. However, experts don’t project home prices to go down anytime soon. Instead, data from earlier in the year has already been adjusted to be higher than previously anticipated.

So, to answer this question… First American explains it like this:

“While house price growth is expected to moderate from the rapid pace of 2021, strong home buyer demand against a backdrop of historically tight inventory of homes for sale will likely keep appreciation positive in the coming year.”

For both buyers and sellers, this means one thing: playing the waiting game is a risky business.

When it comes to sellers, the higher price appreciation over the last two years has been great for your home’s value. But if you will also be buying a home after selling, you shouldn’t wait for prices to fall.

In both cases, waiting will only cost more in the long run because climbing mortgage rates and rising home prices will have an impact on your next home purchase.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Start with the lawn

Start with the lawn

Especially during the aftermath of hurricanes, we learn just how many Americans lack hazard insurance. Those who did have it faced the challenge of trying to figure out how to tally up their losses. It’s not easy to recall everything one owns, especially when confronting devastation. Then, there are the other losses a homeowner might face, such as those from theft and fire.

Especially during the aftermath of hurricanes, we learn just how many Americans lack hazard insurance. Those who did have it faced the challenge of trying to figure out how to tally up their losses. It’s not easy to recall everything one owns, especially when confronting devastation. Then, there are the other losses a homeowner might face, such as those from theft and fire.

If you’re like many gardeners, your shovels, shears, and other tools have been sitting in the shed since last season and likely need a little TLC. If a deep clean is in order, a soapy rinse and soak paired with a scrub brush should do the trick. Wooden handles? Give them a light sanding to help remove splinters.

If you’re like many gardeners, your shovels, shears, and other tools have been sitting in the shed since last season and likely need a little TLC. If a deep clean is in order, a soapy rinse and soak paired with a scrub brush should do the trick. Wooden handles? Give them a light sanding to help remove splinters.

Your keyboard is full of cooties. Well, not exactly, but you may never look at a keyboard the same way when you learn that it’s dirtier than your bathroom.

Your keyboard is full of cooties. Well, not exactly, but you may never look at a keyboard the same way when you learn that it’s dirtier than your bathroom.