Common Real Estate Terms Explained

If you’re a first-time homebuyer, chances are you’ll come across some terms you’re not familiar with. And that can be overwhelming, especially while going through one of the biggest purchases of your life.

The good news is you don’t need to be an expert on real estate jargon. That’s your agent’s job. But getting to know these basic terms will help you feel a lot more confident throughout the process.

Terms Every Homebuyer Should Know

Once you’re familiar with this terminology, you’ll have a better understanding of important details – from contracts to negotiations. So, when those big conversations happen, you’ll feel informed, in control, and able to make the best decision for your unique situation. As Redfin puts it:

“Having a basic understanding of important real estate concepts before you start the homebuying process will give you peace of mind now and could save you a fortune in the future.”

Here’s a breakdown of a few key real estate terms and definitions you should know, according to the Federal Trade Commission (FTC) and First American.

Appraisal: A report providing the estimated value of the home. Lenders rely on appraisals to determine a home’s value, so they’re not lending more than it’s worth.

Contingencies: Contract conditions that must be met, typically within a certain timeframe or by a specified date. For example, a home inspection is a common contingency. While you can waive these to try and make your offer more competitive, it’s generally not recommended.

Closing Costs: A collection of fees and payments made to the various parties involved in your home purchase. Ask your lender for a list of closing cost items, including attorney’s fees, taxes, title insurance, and more.

Down Payment: This varies by buyer, but is typically 3.5-20% of the purchase price of the home. There are even some 0% down programs available. Ask your lender for more information. Chances are, unless specified by your loan type of lender, you don’t need to put 20% down.

Escalation Clause: This is typically used in highly competitive markets. It’s an optional add on in a real estate contract that says a potential buyer is willing to raise their offer on a home if the seller receives a higher competing offer. The clause also includes how much a buyer is willing to pay over the highest offer.

Mortgage Rate: The interest rate you pay when you borrow money to buy a home. Consult a lender so you know how it can impact your monthly mortgage payment.

Pre-Approval Letter: A letter from a lender that shows what they’re willing to lend you for your home loan. This, plus an understanding of your savings, can help you decide on your target price range. Getting this from a lender should be one of your first steps in the homebuying process, before you even start browsing homes online.

Bottom Line

You don’t need to have all these terms memorized, but a little knowledge goes a long way. Brushing up on the basics now means fewer surprises later – and more clarity when you buy a home.

What unfamiliar real estate term or phrase have you come across that wasn’t on this list?

Let’s connect and talk through it so you have a solid understanding of what it means and where it may show up in the homebuying process.

Do You Need a Real Estate Agent for New Construction? Here’s Why the Answer is Yes

Buying a brand-new home has obvious appeal—everything is fresh, modern, and move-in ready. But if you’re working directly with a builder, you might wonder: Do I really need a real estate agent for new construction?

The short answer is yes. While builders have their own sales teams (often called builder’s agents), those professionals are hired to represent the builder’s best interests—not yours. That means you could be going into one of the biggest financial decisions of your life without someone truly in your corner.

From negotiating upgrades to reviewing contracts and spotting hidden costs, a real estate agent can be an invaluable ally when buying a new build. Here’s why bringing your own agent to the table can save you money, reduce surprises, and help protect your long-term investment.

What is a builder’s agent in new construction?

When you buy a new construction, the home’s builder is considered the seller, and the agent representing the builder is called the builder’s agent.

The builder’s agent will always have the builder’s best interest in mind.

After all, the job of the builder’s agent is to get the highest price for the homes the builder is selling so the agent is not going to be as eager to negotiate down.

Why you still need a real estate agent when buying a new build

It’s a smart move to bring your real estate agent with you on your first visit to a new construction site—or at the very least, make sure they’re properly registered with the builder beforehand.

The builder is usually the one paying the buyer’s agent’s commission, and many builders require that agent to be present or registered at the initial visit in order to qualify for payment.

If you show up without your agent and start working directly with the builder’s sales rep, some builders may refuse to pay your agent’s commission later. That can leave you without representation—or footing the bill yourself if you still want their help. To avoid that, always notify the builder in advance (or at check-in) that you’re working with a licensed agent.

Taking this step from the start ensures your agent can advocate for you through every stage of the build.

“Your real estate agent’s job is to help you get the most value for your money, with the least hassle and frustration,” says Patrick Welsh, a real estate agent with Keller Williams, in Houston.

When buying new construction, here’s what your real estate agent will help you with that you might miss out on if you stick with the builder’s agent:

Your agent can negotiate upgrades

Want upgraded counters or appliances in that new home? Your agent can help you with all those extra perks, amenities, and upgrades. “We can often negotiate with the builder on things like paint color or even the style of garage door, especially if the housing development is in the beginning stages,” Walgrave says.

Your agent can connect you with the best lender (for you)

A builder typically will have a “preferred” lender that it will try to steer you to, but your real estate agent can help make sure that you’re getting the mortgage that works best for your situation. Shopping around is always wise, and you don’t want the builder’s agent pressuring you into using their suggested professional unless it’s right for you.

Your agent will push for a proper inspection

Tempted to forgo a home inspection in new construction? Don’t do it, advises Welsh. “The number and severity of new-home defects often rival resale home problems,” he says.The builder’s agent is unlikely to push for or offer up an inspection, so it’s up to you and your real estate agent to make it happen.

How the builder’s agent can help you

All that said, the builder’s agent can be a valuable resource for learning about your potential new home.

“They are knowledgeable about the construction and available amenities, as well as the housing development and general community vibe,” says Walgrave. You can rely on the builder’s agent for background information—just don’t make this individual your sole point of contact on the buying and selling process.

Everyone wants to walk away from buying a home—whether it be a new construction or not—with peace of mind. Having a real estate agent in your corner will help facilitate that.

The ROI of Renovation

If that kitchen needs new countertops, your roof leaks or you want to swap out an old tub for a new shower, the cost might seem like a major deterrent.

But if you’re a homeowner with equity in your property, a Home Equity Line of Credit (HELOC) could be just the answer. A HELOC allows you to borrow funds based on the value of your home and it gives you plenty of time to pay it back.

Ready to explore what you can do with a HELOC?

A HELOC could offer flexibility when you need funds for projects, and unlike a home equity loan which provides a lump-sum upfront, a HELOC allows you to access cash during a set period.

Called the draw period, it typically lasts five to 10 years. You can use your HELOC funds for home improvement, giving you more freedom than a traditional second mortgage or personal loan.

Using the ROI as a benchmark, you can examine the numbers with a critical eye to help you finalize and prioritize your renovation goals. Often, a look at the numbers can help you determine whether a particular renovation is a critical must-have or whether it can wait its turn in favor of other home-improvement projects.

To help you out, we’ve compiled a list of some of the most sought-after renovations in the market today, along with their ROI percentages and commentary on how those numbers have changed from 2023.

When it comes time for you to dive into your renovation to-do list, we’re here to help you find the financing solution that makes sense for you, your family and your unique circumstances. So if you are ready to get going on home renovations of practically any scope from the minor to the extensive, we recommend speaking to one of our Loan Officers. We have many different types of renovation loan options and home equity products like a home equity line of credit to help you bring your vision of your home to reality. With that in mind, let’s dive in.

Worth vs. value

It’s no secret that home renovations can be expensive and invasive. The latter is especially the case if you work from home. Depending on the intensity and complexity of the renovations in question, you might find that you need to relocate the family while renovations are underway. It can likewise take some time after the renovations are over to get some sense of normalcy back.

We mention these factors not to put you off of renovations but to make sure that you factor these aspects into your thinking. After all, whether renovations add value to your home and whether they are worth it to you can be two very different things.

With that in mind, there are two things you should ponder before embarking on your home’s journey of renewal. For each renovation, consider the following:

- The total cost of the renovation vs. the quality of life it will add

- The renovation’s worth in terms of the value it will add to your home

Ultimately, whether a particular renovation is worth the cost and interruption is highly subjective. There’s nothing wrong with making a renovation simply because you want it or because it brings you joy. The list we’ve prepared here with the ROI numbers is simply to give you a framework so that you can get an at-a-glance view into how much popular renovations can add, on average, to the value of your home.

ROI numbers

Return on investment (ROI) for home renovations is measured by how much of the cost of a particular renovation is recouped once the house is sold relative to how much it costs overall. The ROI numbers presented here are national averages. These can vary from region to region depending on a number of factors, so bear that in mind as you read, and categorize them as estimations.

So let’s take a look at Remodeling magazine’s yearly release of their Cost vs. Value report.1 With that as our guide, here are the relative ROI rates of some of the most popular renovations:

HVAC Conversion/Electrification:

- Cost: $18,800

- Value added: $12,422

- ROI: 66.1%

Our first item on this list is one that proved quite popular last year with a 103.5% ROI. That number fell to 66.1% in 2024, however. While there are any number of factors that could affect why converting a home’s HVAC system from fossil fuels to purely electricity could have fallen off so much in a year, this does prove one of the biggest downward changes from 2023.

Something to note, however, is that such a renovation’s ROI is never more relevant than in the year that the house is sold. So, if you just completed this type of upgrade but don’t think you’ll sell your house for a few more years, don’t worry. Historically, this is one of the most reliable and sound renovations.

Garage Door Replacement:

- Cost: $4,513

- Value added: $8,751

- ROI: 193.9%

In sharp contrast to the HVAC conversion, garage door replacement has skyrocketed in value since last year. In 2023, this renovation already boasted an impressive rate of 102.7% value, meaning that the renovation effectively paid for itself and then some. Now in 2024, the ROI is an incredible 193.9%! Considering that this type of upgrade has the lowest costs on this list, it makes it an ideal starting place for homeowners beginning their suite of renovations.

Manufactured Stone Veneer:

- Cost: $11,287

- Value added: $17,291

- ROI: 153.2%

Another renovation that had over a 100% ROI last year, a manufactured stone veneer on the exterior of a home has continued to rise in popularity in a big way. From 102.3% in 2023, its ROI increased to 153.2%. Considering the relatively low price overall, this is another way that homeowners can dramatically spruce up the appearance of their home at first glance while increasing the property value. It also goes to show the enduring power of curb appeal to potential buyers.

Minor Kitchen Remodel – Midrange:

- Cost: $27,492

- Value added: $26,406

- ROI: 96.1%

Major Kitchen Remodel – Midrange:

- Cost: $79,982

- Value added: $39,587

- ROI: 49.5%

Major Kitchen Remodel – Upscale:

- Cost: $158,530

- Value added: $60,176

- ROI: 38.0%

So far, we’ve covered renovations that have undergone radical changes, both up and down. All three kitchen remodel types, however, do show differences from 2023, though perhaps not to as great of a degree.

Overall, all three increased slightly in price. (That’s pretty common across the board when you factor in general inflation and economic factors.) The ROI ticked up for all three as well. The midrange minor remodel was the clear winner of the three with its ROI going up to 96.1%, a 10.4% increase from last year. Both the midrange major remodel and the upscale remodel did increase by around 7% from last year, but their overall ROI numbers are far lower for the effort and resources involved at 49.5% and 38%, respectively.

Still, the kitchen is likely the first thing a potential buyer might notice in a house without furniture, and the advantages of having a fully-modernized and upgraded kitchen while you’re living in the house can seldom be overstated.

Siding Replacement

Fiber cement:

- Cost: $20,619

- Value added: $18,230

- ROI: 88.4%

Vinyl:

- Cost: $17,410

- Value added: $13,957

- ROI: 80.2%

As we stated earlier, curb appeal is a tried-and-true approach to hook your buyer before they even set foot in the house itself. As a stone veneer is one way to increase that perceived value, siding is another way to beautify and protect the exterior of the home. Not surprisingly, both types of siding have solid ROI numbers behind them this year. Fiber cement was largely unchanged, with only a 0.01% drop in ROI from last year.

Vinyl, while still viable, did see its own ROI drop by 14.5% to its current position at 80.2%. This would suggest that the increased durability and fire-resistance of fiber cement over vinyl is more attractive to renovators looking to preserve their homes against the elements.

Window Replacement

Vinyl:

- Cost: $21,264

- Value added: $14,270

- ROI: 67.1%

Wood:

- Cost: $25,799

- Value added: $16,222

- ROI: 62.9%

Next, we look at a category that is very close in both average price and ROI to what they were a year ago. Both types of window replacement increased slightly in price (again, not a surprise). Where they differ, however, is that the ROI for vinyl window replacements dropped by 1.4% to settle in at 67.1%. On the other hand, wood window replacements increased by 1.7% to 62.9%. Not a severe change either way, though it is interesting to note how housing accessories do seem to be trending away from vinyl.

Deck Addition

Wood:

- Cost: $17,615

- Value added: $14,596

- ROI: 82.9%

Composite:

- Cost: $24,206

- Value added: $16,498

- ROI: 68.2%

Decks have long been an in-demand home feature across the country, particularly in the warmer months when summer get-togethers and cookouts are the norm. It seems that decks of both the wood and composite types have seen a jump in their ROI numbers. Though changing very little in price, their return-on-investment numbers have increased from 50.2% to 82.9% for wood and 39.8% to 68.2% for composite. While these numbers may not be as high as other renovation types, their sharp increase would seem to tell the tale that the demand for decking is on the rise.

Bath Remodel

Midrange:

- Cost: $25,251

- Value added: $18,613

- ROI: 73.7%

Universal Design:

- Cost: $40,750

- Value added: $20,148

- ROI: 49.4%

Upscale:

- Cost: $78,840

- Value added: $35,591

- ROI: 45.1%

When it comes to remodeling your bathroom, there’s definite good news and bad news here. The good news is that — overall — all three scales of bathroom remodel have remained close to their price tags from last year while increasing in ROI. The downside is that the more upscale the renovations, the lower the ROI numbers become. This was the case in 2023 as well. The upscale bathroom remodel clocks in at the lowest of the three at 45.1%, though that number is up from 36.7% previously.

Primary Suite Addition

Midrange:

- Cost: $164,649

- Value added: $58,484

- ROI: 35.5%

Upscale:

- Cost: $339,513

- Value added: $81,042

- ROI: 23.9%

Adding or overhauling the space of the primary suite of your home can definitely be an extra draw for would-be homebuyers. Whether that takes the form of adding a new bedroom, installing a gas-powered fireplace with its own chimney, rearranging the internal configuration of your home or all of the above, you’re adding features that could help your home sell quickly.

In the spirit of caveat emptor (Latin for “let the buyer beware”) however, the high price tag of such a monumental undertaking may not favor a return on the kind of money it takes to make such a change. In both categories the ROI percentage did increase, but we hasten to add that the ROI tends to be low relative to the cost. The upscale category, for example, has the lowest ROI of any on this list at just 23.9%, but also has the highest price of any entry here as well. So, if you plan to make such a change to your home, be prepared for it to only give back a third or quarter of what you put into it.

Final thoughts

ROI may not be the end-all be-all deciding factor for you.

Some renovations may be necessary, such as to accommodate the addition of a new family member, whether a baby or an elderly relative. Or perhaps you just need to liven up the space to give you some much-needed quality-of-life improvements.

A Home Equity Line of Credit can be a smart way to tap into your home’s value when you need extra funds, but it’s important to borrow wisely.

A HELOC gives you access to money on an as-needed basis—often with a lower interest rate than a credit card or personal loan.

© 2024 Hanley Wood Media Inc. Complete data from the Remodeling 2024 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

Written and shared from Matthew Dewoskin

A Tale of Two Housing Markets

For a long time, the housing market was all sunshine for sellers. Homes were flying off the shelves, and buyers had to compete like crazy. But lately, things are starting to shift. Some areas are still super competitive for buyers, while others are seeing more homes sit on the market, giving buyers a bit more breathing room.

In other words, it’s a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

What Is a Buyer’s Market vs. a Seller’s Market?

In a buyer’s market, there are a lot of homes for sale, and not as many people buying. With fewer buyers competing for these homes, that means they generally sit on the market longer, they might not sell for as much as they would in a seller’s market, and buyers have more room to negotiate.

On the flip side, in a seller’s market, there aren’t enough homes for sale for the number of buyers who are trying to purchase them. Homes sell faster, sellers often get multiple offers, and prices shoot higher because buyers are willing to pay more to win the home.

The Market Is Starting To Balance Out

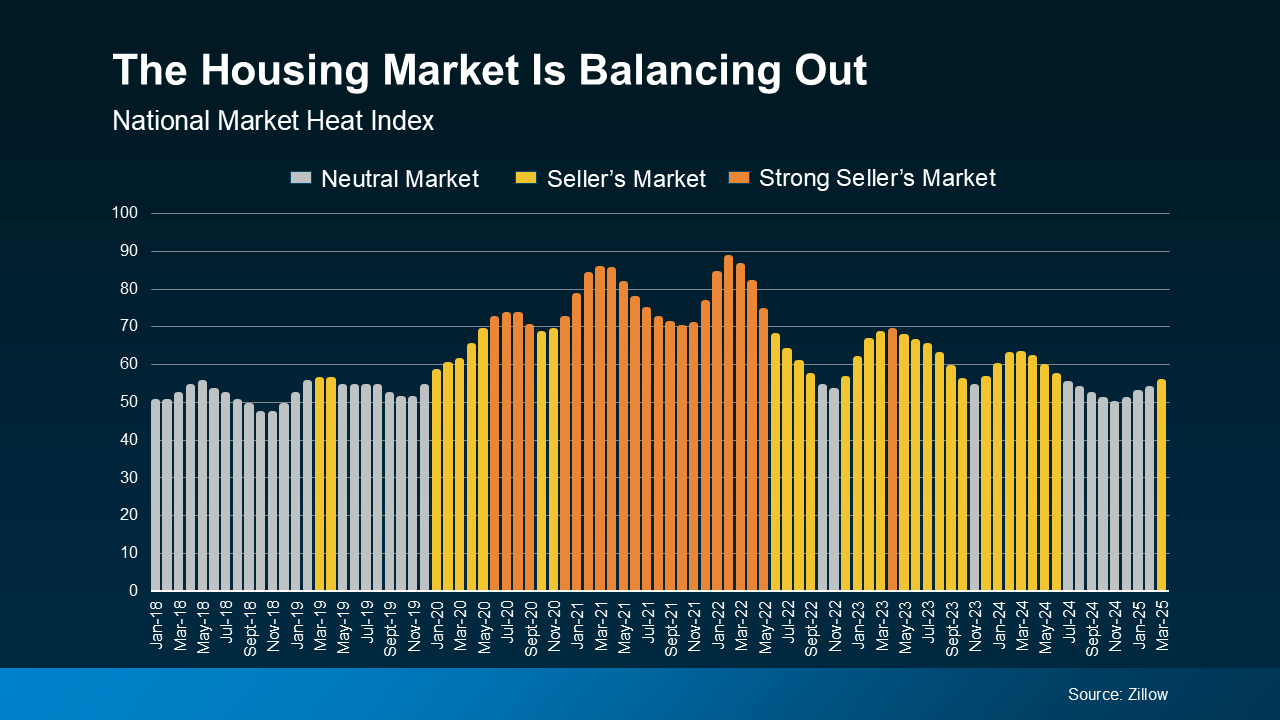

For years, almost every market in the country was a strong seller’s market. That made it tough for buyers – especially first-timers. But now, things are shifting. According to Zillow, the national housing market is balancing out (see graph below):

The index used in this graph measures whether the national housing market is more of a seller’s market, buyer’s market, or neutral market – basically, whether it favors buyers, sellers, or if it’s not really swinging either way. Each month, the market is measured between 0 and 100. The closer to 100, the bigger the advantage sellers have.

The orange bars in the middle of the graph show the years when sellers had their strongest advantage, from 2020 to early 2022. But, as time has gone on, the market has become more balanced. It shifted from a strong seller’s market to a less intense one. And lately, it’s been neutral more than anything else (that’s the gray bars on the right side of the graph). That means buyers are gaining some negotiating power again.

In a more balanced or neutral market, homes tend to stay on the market a little longer, bidding wars are less common, and sellers may need to make more concessions – like price reductions or helping with closing costs. That shift gives today’s buyers more opportunities and less competition than a couple of years ago.

Why Are Things Changing?

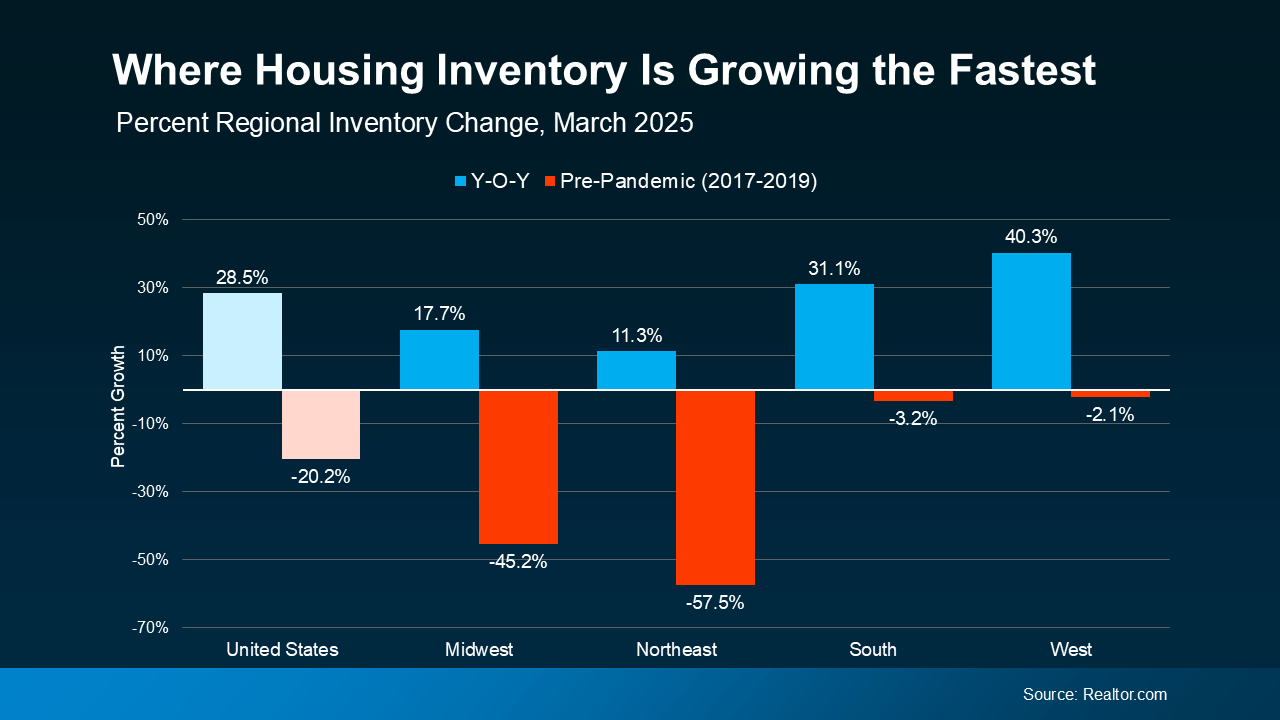

Inventory plays a big role. When there are more homes for sale, buyers have more options – and that cools down home price growth. As data from Realtor.com shows, the supply of available homes for sale isn’t growing at the same rate everywhere (see graph below):

This graph shows how inventory has changed compared to last year (blue bars) and compared to 2017–2019 (red bars) in different regions of the country.

The South and West regions of the U.S. have seen big jumps in housing inventory in the past year (that’s the blue on the right). Both are almost back to pre-pandemic levels. That’s why more buyer’s markets are popping up there.

But in the Northeast and Midwest, inventory is still very low compared to pre-pandemic (that’s why those red bars are so big). That means those areas are more likely to stay seller’s markets for now.

What This Means for You

Every local market is different. Even if the national headlines say one thing, your town (or even your neighborhood) could be telling a totally different story.

Knowing which type of market you’re in helps you make smarter decisions for your move. That’s why working with a local real estate agent is so important right now.

As Zillow says:

“Agents are experts on their local markets and can craft buying or selling strategies tailored to local market conditions.”

Agents understand the unique trends in your area and can help you make the best choices, whether you’re buying or selling. With their expert strategies, you can move no matter which way the market is leaning, because they know how to navigate various levels of buyer competition, how to find hidden gems locally, how to price a house right, how to negotiate based on who has more leverage, and more.

Bottom Line

If you’re ready to make a move, or even just thinking about it, let’s connect. That way, you’ll have someone to help you understand our local market and create a game plan that works for you.

What’s one thing you’re curious about when it comes to the market in our area?

Housing market shifts to favor buyers — but they’re not buying

Like much else about the U.S. economy, tariffs and broader uncertainty are weighing on home sales amid the industry’s crucial spring season.

In March, more than 375,000 homes were newly listed on the market — an increase of nearly 9% compared to the same time last year, according to Zillow Group Inc. (Nasdaq: ZG) research. But newly pending sales were flat compared to last year, despite slightly lower average mortgage rates in March 2025 compared to a year ago.

That’s despite several aspects of the market — including price cuts hitting their highest point in at least seven years — shifting to favor buyers.

Inventory rose to 1.15 million homes in March, an increase of 19% from last year and the most inventory for buyers in the month of March since 2020, according to Zillow. Inventory is now about 24% below 2018 and 2019 averages for the spring housing market.

During the four-week period that ended April 13, the median home-sale price was down from the same time a year ago in 10 of the 50 most populous U.S. metro areas, most especially in Texas and Florida, according to Redfin Corp. (NASDAQ: RDFN).

That’s because supply is outpacing demand in most places, especially in hot Sun Belt metros that’ve seen a lot of homebuilding and in-migration that’s cooled since its pandemic peak.

Homes today are also sitting on the market for longer. The typical home that went under contract in March had been listed for 47 days, according to Redfin. That’s the slowest pace tracked by Redfin since the Covid-19 pandemic.

These factors are adding up to a sluggish spring homebuying season, usually the start of the housing market’s most active time of year. And while the U.S. housing market is finally shifting to favor buyers, the underpinnings for that change aren’t necessarily in buyers’ favor.

“We really haven’t seen that big spring lift that’s in the traditional spring selling season, where sales spike up and you hit that peak,” said Sean Fergus, executive director of economic research at real estate data firm Zonda. “It feels like it’s a little bit in a holding pattern, with so much uncertainty and volatility in the market right now.”

Among new-home sales tracked by Zonda, 650,355 new homes sold in March at a seasonally adjusted annualized rate, a decline of 3.2% from February and down 11.5% from a year ago.

In its monthly survey, Zonda also found 32% of builders lowered their prices in March, 53% held prices flat and 15% raised prices. In February, 21% of builders lowered their prices from the month prior, 61% kept prices the same and 18% raised their prices.

The slowdown in new-home sales comes as builders are grappling with higher materials and labor costs because of White House tariff and immigration policy.

“Some of the markets are seeing softness in home prices, like Florida and Texas, and an increase in new home inventory sitting there,” said Brian Bernard, director of industrials equity research at Morningstar who tracks public homebuilders. “If the spring selling season is solid, it would work through that, but it feels like this season has been mixed, at best. If [builders] don’t have a great spring selling season, that’s more of a reason for pullback on starts.”

One positive from the amount of resale listings coming to market means the market is moving to a healthier inventory level than it’s had for some time, Fergus said. More options within the greater housing market is ultimately a good thing, he added.

And while new home sales have pulled back about 10% in the past year, according to Zonda, they’re still 4% higher than they were at this time in 2019, Fergus said.

“[More inventory] could have longer upside potential, especially if rates come down, attracting more potential buyers,” Fergus said, although he added Zonda is not expecting mortgage rates to come down significantly in the near term.

Mortgage rates, a key lever in the housing market, have also not moved much recently, with the 30-year fixed rate hitting an average of 6.83% last week, according to Freddie Mac data. Rates have largely been hovering in the mid- to high 6% to low 7% range for the past year.

Shift to a buyer’s market

The change happening in the housing market is somewhat nuanced. It’s not that buyer demand has recently or suddenly dropped off but, rather, demand from homebuyers isn’t growing while supply is.

Chen Zhao, head of economics research at Redfin, said homebuyer demand has actually been weakening since mid-2022, when interest rates began to rise. But since that time, and through 2024, supply remained low. Inventory in recent weeks and months has been picking up, through both new construction and resale homes.

“You might expect that, since 2023 or 2024, as people get more used to these high mortgage rates, demand would naturally start to increase,” Zhao said. “And demand would have to increase in some sense if you have more homeowners selling their homes — a lot of them have to buy another home if they’re move-up buyers. Demand is somehow not increasing.”

That’s because economic turmoil has sidelined buyers who now may be more reticent to make what’s likely the biggest investment of their lives by purchasing a house, both Zhao and Fergus said.

Cameron LaPoint, assistant professor of finance at the Yale School of Management whose research includes housing affordability, said in addition to consumer sentiment, major climate events, such as last fall’s hurricanes and the wildfires in Los Angeles in January, may also be cutting demand for housing. He added tariff’s ripple effects could make other monthly housing costs more expensive, too, such as homeowners insurance, which has already been soaring in recent years because of more severe weather risks from climate change.

Homes are now spending four additional days on the market compared with this time last year, according to Realtor.com. And more sellers are slashing their prices, with about 23% of the listings on Zillow receiving a price cut in March — the highest share for any March since at least 2018, according to Zillow.

While price cuts may be welcome in a housing market laden with affordability challenges, especially since the pandemic, many would-be buyers are pausing big purchases right now.

“Some are saying, if [there’s] a recession, mortgage rates will fall, that will bring back housing demand,” Zhao said. “If you’re in a recession with the [higher] tariffs, I’m not even sure mortgage rates will fall. That also doesn’t necessarily bring back demand, depending on the severity of the recession. If we assume mortgage rates stay where they are, you can have higher demand than what we’re seeing right now.”

For buyer demand to come back meaningfully, consumers need to have more certainty about the direction of the economy, she added.

Shared By Ashley Fahey – Managing Editor, National Content, Austin Business Journal

The Inventory Dilemma: Why Existing-Home Sales Are Falling Short

April 24, 2025

Existing-home sales have lagged over the past two years, while new-home sales have surged—highlighting a key dynamic: Buyer demand remains strong when inventory is available.

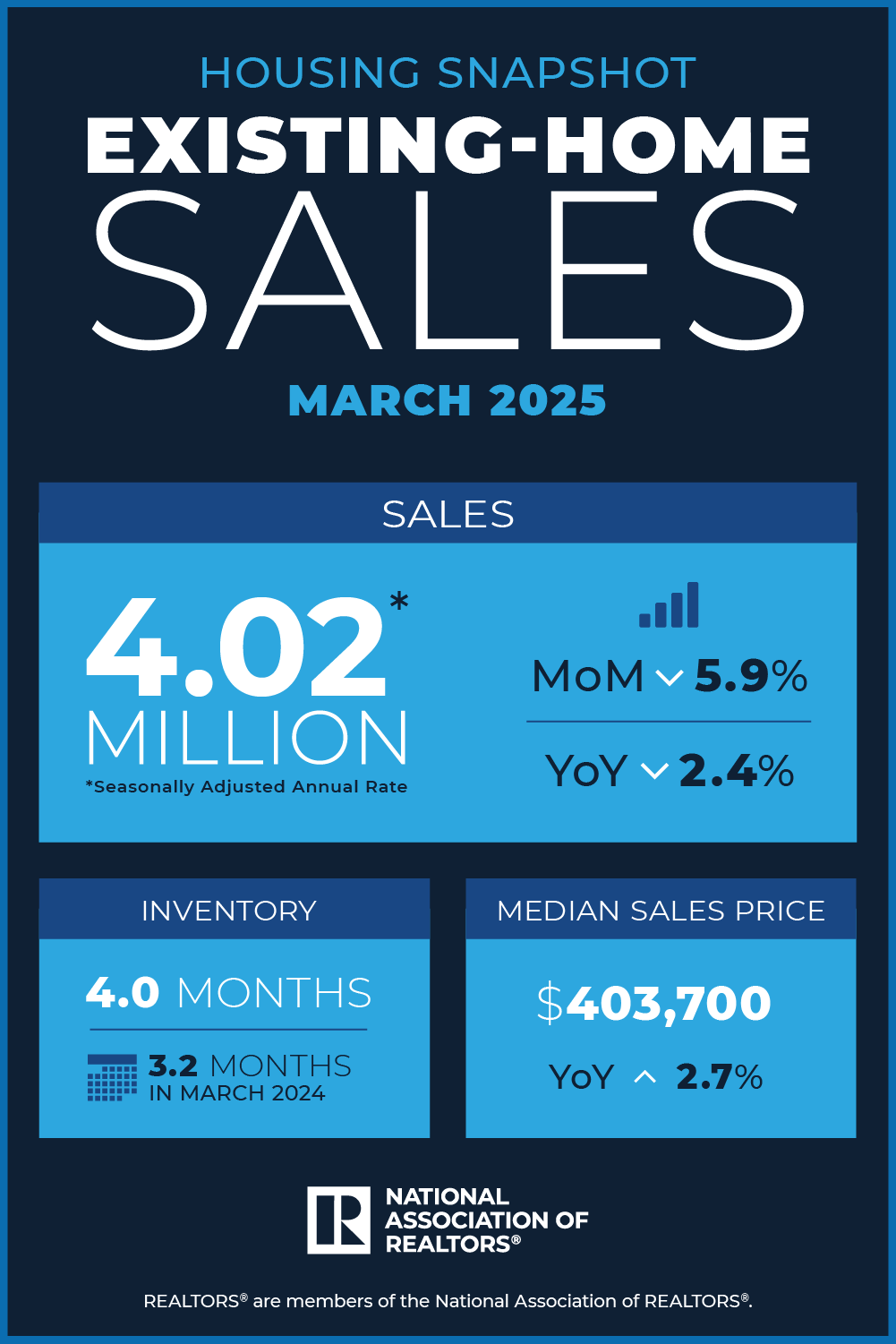

The existing-home market continues to face a short supply of homes for sale, despite the latest progress of a 20% annual uptick in inventory. With just a 4 months’ supply of inventory, existing-home sales fell nearly 6% in March compared to February. Sales were down 2.4% from a year ago, the National Association of REALTORS® reported Thursday.

“That may begin to shift,” says Lawrence Yun, NAR’s chief economist. “As time passes, life events—such as job changes, family transitions or financial needs—could prompt more homeowners to sell, even if it means giving up their low locked-in mortgage rates.”

As it stands now, about 44 million homeowners have a mortgage rate below 6%, according to an NAR analysis. That’s lower than the current 30-year fixed-rate mortgage, which has been averaging in the mid- to high 6% range. Buyers with financial wherewithal are bypassing mortgages altogether: All-cash buyers continue to make up a sizable share of the market, comprising 26% of existing-home sales transactions in March, according to NAR’s data.

Proof Buyers Are Still Out There

Even with last month’s slide in existing-home sales, buyers could still face some competition. Twenty-one percent of homes sold above list price in March, and 57% of real estate pros report that properties typically sold in just over a month, according to the March REALTORS® Confidence Index Survey, reflecting results from a survey of more than 1,500 real estate pros about their latest transactions. Homes listed received an average of 2.4 offers. What’s more, 22% of buyers waived the inspection contingency and 19% waived their appraisal contingency in competing in a home sale last month.

Home prices also are still climbing: The median existing-home sales price in March reached an all-time high of $403,700, NAR reports.

Contrasting housing prices with recent stock market declines, Yun says, “Household wealth in residential real estate continues to reach new heights. With mortgage delinquencies at near-historical lows, the housing market is on solid footing.”

Signaling further potential buyer interest, mortgage applications for home purchases are up 4.3% year-to-date. “Aside from inventory growth, lower mortgage rates will be needed to get homeowners to move,” Yun says. “A small deceleration in home price gains, which was slightly below wage-growth increases in March, would be a welcome improvement for affordability.”

Builders Capitalize on Demand but Face Headwinds

Meanwhile, homebuilders have plenty of inventory—and in some cases, lower mortgage rates—to meet some of that pent-up buyer demand. Sales of newly built homes climbed 7% in March compared to the previous month and are up 6% from a year ago, the U.S. Department of Housing and Urban Development and the U.S. Census Bureau reported on Wednesday.

“A wide inventory availability—at eight months’ supply—is helping newly constructed home sales to move forward,” Yun says. “The homebuilders’ focus on smaller-sized homes is also attracting buyers.” New home sales are up 33% year-to-date for homes priced below $300,000 and up by 28% year-to-date for new homes priced between $300,000 and $400,000, NAHB reports.

In March, the median price of newly constructed homes was $403,600, well-below the $435,000 price from three years ago when builders were more focused on larger-sized homes, Yun adds.

Builder incentives also could be drawing buyers in. About 30% of builders say they cut their home prices in April, with the average price reduction at 5%, according to the NAHB and Wells Fargo Housing Market Index. About 61% of builders say they also used sales incentives this month, like with mortgage rate buy downs or upgrades.

“The new home sales data shows that demand continues to be present in the market, provided affordability conditions permit a purchase,” says Buddy Hughes, NAHB’s chairman. “An increase in economic certainty would be a big boost to future sales conditions.”

Uncertainty looms, however, particularly around the potential impact new tariff policies could have on the new-home industry. Sixty percent of builders reported that suppliers have already increased or have announced tariff-related price increases for materials—an uptick of 6.3%, on average. Builders estimate that recent tariff actions could increase the cost of a newly built home by about $10,900 per home.

“Builders have expressed growing uncertainty over market conditions as tariffs have increased price volatility for building materials—at a time when the industry continues to grapple with labor shortages and a lack of buildable lots,” Hughes said.

The #1 Thing Sellers Need To Know About Their Asking Price

When you put your house on the market, you want to sell it quickly and for the best price possible; that’s generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.

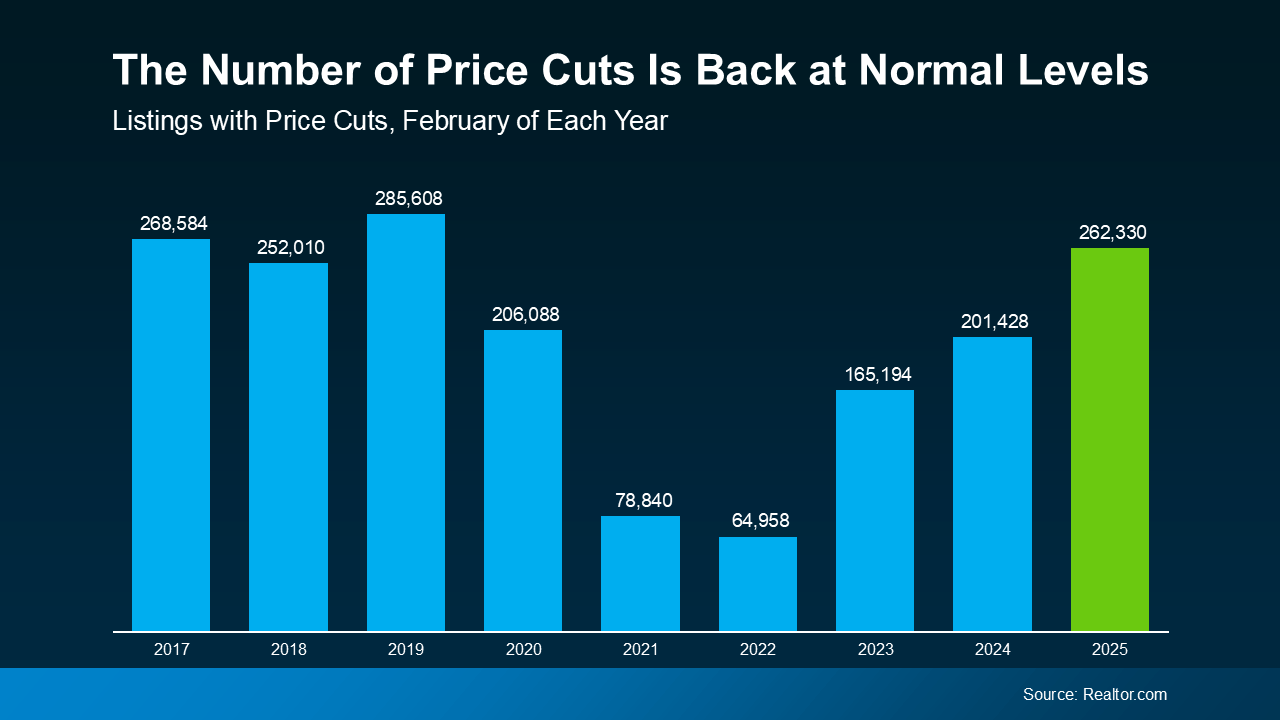

According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):

If you consider that 2019 was the last true normal year for the housing market – that’s a big deal. We’re getting back to what’s typical for the market.

This isn’t the same frenzied seller’s market we saw a few years ago. You may not get the same price your neighbor did at the height of the pandemic. And that means you may need to reset your expectations.

Because here’s the reality. If you shoot too high and have to lower your price after the fact, you could actually end up walking away with lower offers than if you’d priced it right from the start. So, how do you avoid that? You lean on your agent.

How an Agent Helps You Nail the Right Price

A great agent doesn’t just pull a number out of thin air. They’ll use real data and market trends to make sure your house is priced based on what your specific home is valued at today. So, you’re setting a realistic price – one that’ll draw in serious buyers.

And based on your agent’s analysis of your local market, they may even recommend strategically pricing slightly below market value to help your house attract more eyes and more competitive offers. Here’s how your agent will determine the right number for your house:

- They look at recent sales. What did similar homes in your area actually sell for? Not list for, sell for.

- They analyze local market trends. Your home’s value isn’t just about what you want for it, it’s about what buyers in your area are willing to pay.

- They craft the right strategy. They’ll make sure your home is priced to attract attention and create a sense of urgency among buyers.

Why Overpricing Backfires

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

- Buyers may not even look at it. Today’s buyers are more budget-conscious than ever. If they see a home that seems overpriced, they’re likely to skip it completely rather than try to negotiate.

- It could sit on the market for too long. The longer your home sits unsold, the more buyers will assume something’s wrong with it. That can make it even harder to sell down the line.

- You might end up getting less. Homes that require a price cut often sell for less than they would have if they had been priced right from the start.

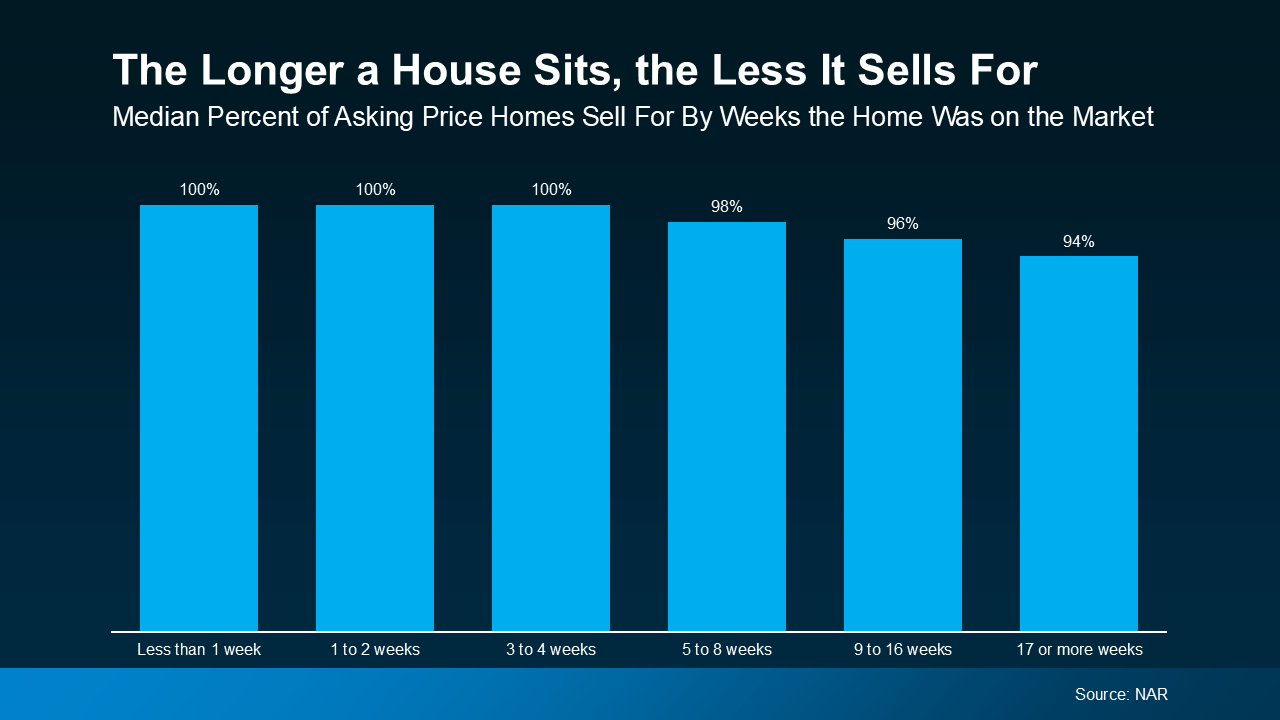

You can see that shake out in the graph below. It uses data from the National Association of Realtors (NAR) to show that the longer a house sits, the less it’ll sell for:

This graph shows that if a house sells within the first 4 weeks it is listed, it usually goes for full price. Based on experience, that’s what usually happens to homes that are priced at or just below current market value. If it’s priced right, buyers will be interested, and, ultimately, willing to pay the asking price – or compete with other buyers and even go over asking.

But if a house isn’t priced right, it doesn’t sell as quickly. And this graph shows that, after the first 4 weeks on the market, the price starts to drop from there. That’s because buyer interest falls off the longer it sits. So, it becomes more likely a seller will either accept a lower offer because that’s all they have, or opt to do a price drop to draw people back in.

Bottom Line

The last thing you want is to list too high, watch your house sit, and then have to drop the price just to get attention. Let’s connect so that doesn’t happen to you.

Want to make sure your home sells quickly and for the best price? Let’s go over the right pricing strategy for your house.

Preserve and Protect your Homestead Exemption

By Roland Love, Independence Title Vice President and Attorney

If you own a home in Texas, your residential homestead exemption is one of the most important tools for reducing your property taxes. But did you know that exemptions aren’t automatic and require monitoring?

With Appraisal District Notices arriving soon, now is the perfect time to check your exemption status and ensure you maximize your savings.

How to Qualify for a Homestead Exemption

Texas Property Tax Code (TPTC) section 11.13 establishes the residential homestead exemption. Notably, the amount is currently $100,000 for school taxes (typically around 50% or more of the property tax total), and the amount of eligible acreage is up to 20 acres. An adult owner or a Qualifying Trust may claim the exemption, and the application may be filed at any time (once the deed is recorded). TPCT 11.42 (f). If it is mid-year and the preceding owner has already claimed the exemption, the County Appraisal District (CAD) will treat the exemption claim as filed on January 1 of the coming year. However, the owner should confirm by checking the Notice when received in the Spring.

Why Monitoring Matters

While the residential exemption continues (TPTC 43(c)) without the need for an annual filing, the 2023 Texas legislature added to section 11.43(h-1), requiring each chief tax appraiser to “review” each residential homestead exemption within a five-year period. This review is being phased in, but the review is often conducted as a letter inquiry. Many appraisal districts use a third-party service to flag probable improper homestead exemption, and the appraisal district will then send a letter of inquiry. The taxpayer may be asked to reapply if the flag was a very positive indicator of an improper exemption. In other instances, the taxpayer is requested to verify the residential homestead.

What to Do If You Receive a Letter

Regardless, if a taxpayer does not respond, the residential homestead exemption can be removed. While a taxpayer can reapply, it can be confusing to handle or be overlooked, and, in particular, if taxes are escrowed, there will be a lender and increased escrow to deal with and unwind. Again, the annual Appraisal District Notice should also be checked for exemptions, but an owner may also check the county appraisal district website for the residential homestead exemption. While all exemptions are typically not shown for privacy reasons, the “HS’ is usually shown for residential homesteads. If not, a call should be made to straighten it out. A new application may be required.

Stay on Top of Your Exemptions

Each homeowner is legally responsible for maintaining exemptions and notifying the CAD when an exemption is no longer applicable. It is also helpful to remind your new homeowners to claim the exemption if desired and continue to monitor its application. And be aware that many appraisal districts do not disclose all exemptions on the public website, so a phone call may be the best option.

Here’s What a Recession Could Mean for the Housing Market

Recession talk is all over the news, and the odds of a recession are rising this year. And that leaves people wondering what would happen to the housing market if we do go into a recession.

Let’s take a look at some historical data to show what’s happened in housing for each recession going all the way back to the 1980s.

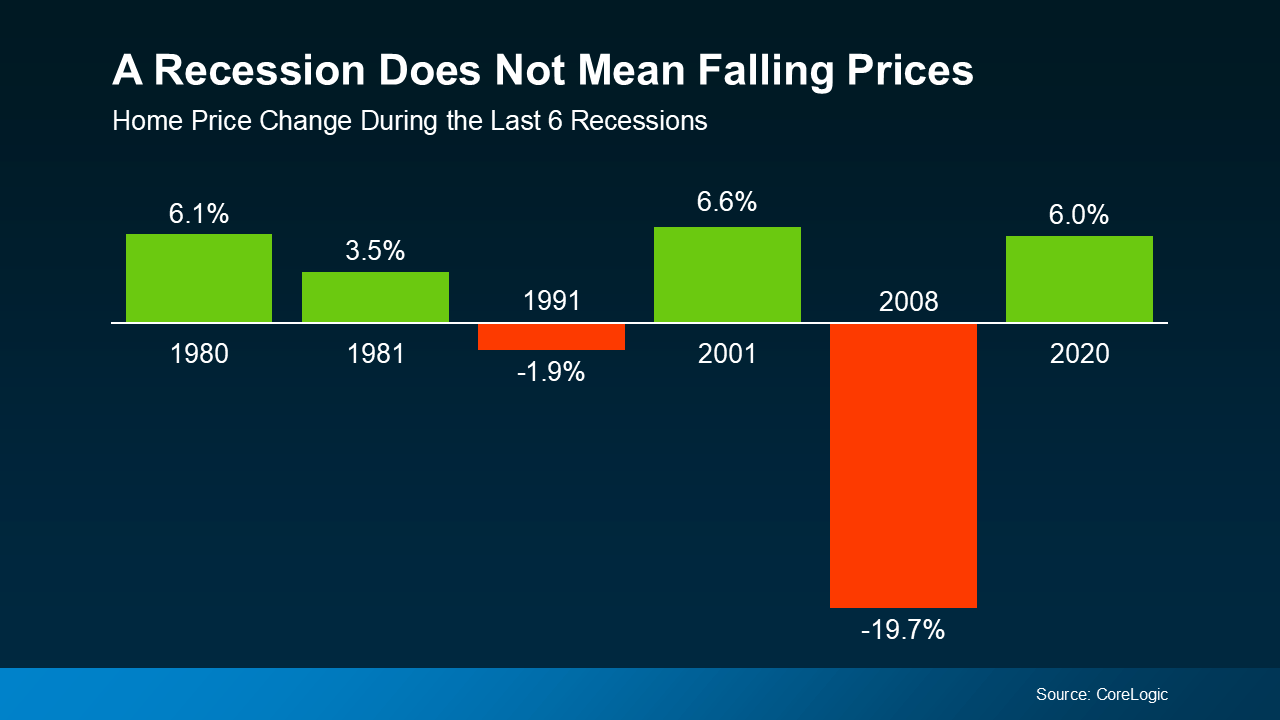

A Recession Doesn’t Mean Home Prices Will Fall

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time we saw such a steep drop in prices. And it hasn’t happened since.

In fact, according to data from CoreLogic, in four of the last six recessions, home prices actually went up (see graph below):

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

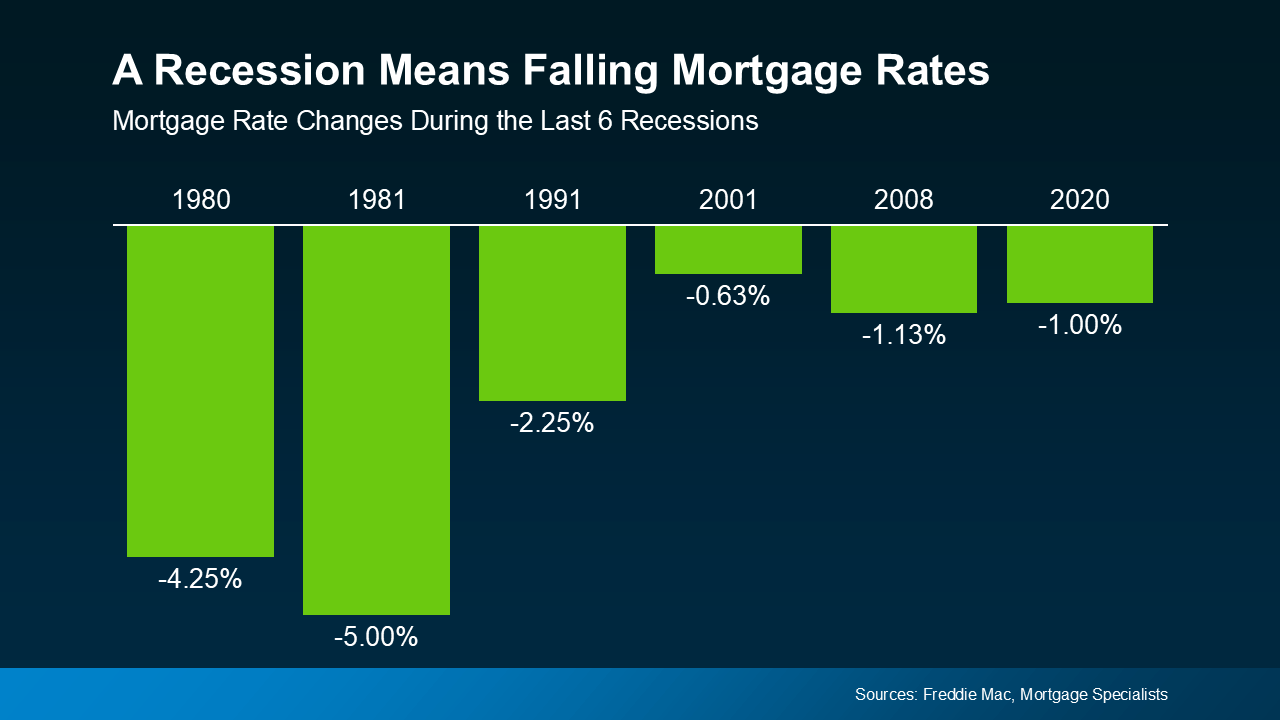

Mortgage Rates Typically Decline During Recessions

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

Bottom Line

The answer to the recession question is still unknown, but the odds have gone up. But that doesn’t mean you have to wonder about the impact on the housing market – historical data tells us what usually happens.

When you hear talk about a possible recession, what concerns or questions come to mind about buying or selling a home?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link