Understanding Flood Insurance Requirement vs Rating

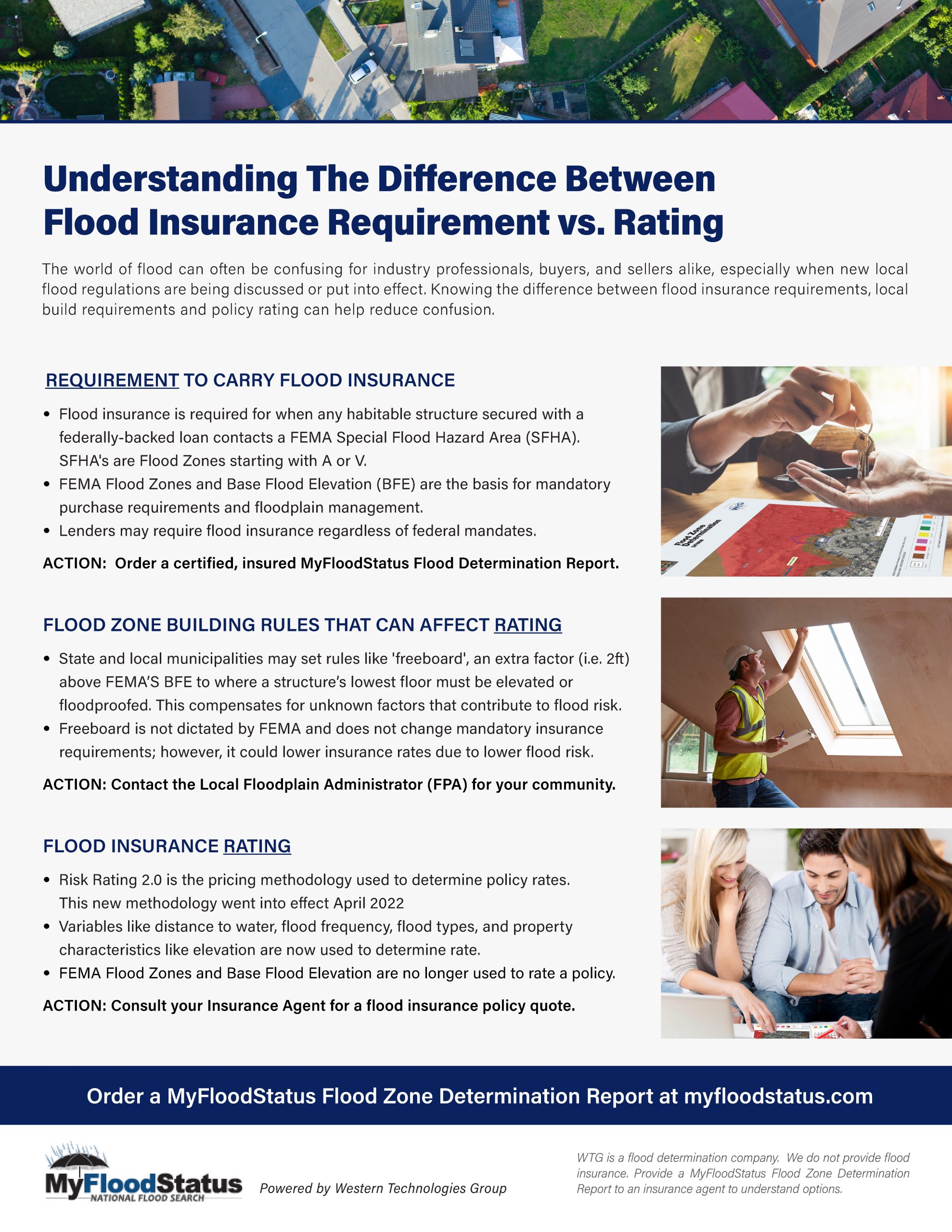

Neither IFPR nor Freeboard change or affect how the mandatory purchase requirement for flood insurance works. Mandatory requirements for flood insurance will still be dictated using FEMA Flood Insurance Rate Maps (FIRMs) and assessing whether the exact location of a habitable structure secured with a federally-backed loan comes into contact with one of the high-risk flood zones known as Special Flood Hazard Areas (SFHAs).

Flood insurance rates, on the other hand, could be positively affected by these variables. For example, the higher a structure is built, the lower the risk of flooding.

To confirm the flood insurance requirements of any property nationwide, simply order a MyFloodStatus flood zone determination report.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link